Steven Cohen: A Hobby That Costs $1 Billion

"Art is a great diversion from looking at numbers" - Steven Cohen

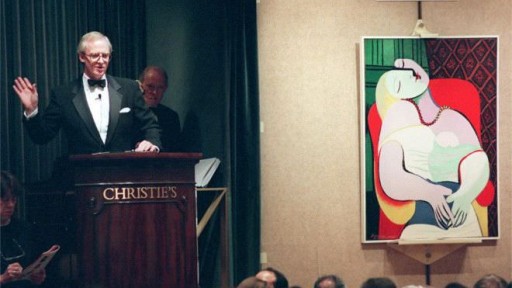

Steven Cohen is not only one of the richest hedge fund managers in the world, but also owns one of the world's greatest private art collection, which includes the most desirable and the most expensive pieces. He is applying his investing style to this collection, which costs about $1 billion of his $11 billion fortune. He regularly sells and buys pieces from the collection both at the auctions and to private buyers. Last year, Cohen was selling two paintings, estimated at about $65 million, at the New York auction.

John Good, a private art dealer in New York states that Cohen is a trader by mentality, but also a great collector and that dealers love people like him. "He used to collect modernism, now he is more into contemporary and classic postwar" - Good says. Currently, Cohen is selling a portrait of Mao by Andy Warhol at more than $40 million, which is 40 times more than its last price.

Cohen started collecting art 16 years ago, in 2000; by now, he has spent more than $700 million. His collection include works of such great artists as: Van Gogh, Gauguin, Andy Warhol, Liechtenstein. The most notable purchases he has ever made were:

2006 de Kooning’s Woman III for $137.5 million

2005 Van Gogh’s Portrait of a Young Peasant Girl for around $80 million

2004 Francis Bacon's Study after Velázquez for $16 million

2004 Andy Warhol's Superman for around $25 million

2004 Jackson Pollock drip painting for $52 million

2001 Madonna, by Munch, for a reported $11 million from US dealer Mitchell-Innes and Nash

In 2005, Cohen has purchased "The Physical Impossibility of Death in the Mind of Someone Living" - a sculpture by Damien Hirst, which is a fourteen-foot tiger shark, that Hirst cut in half and displayed in formaldehyde. The price of the sculpture, according to sources close to Cohen, was around $12 million.

Last year, Cohen secretly purchased Alberto Giacometti’s 1947 masterpiece "Man Pointing" for $141.3 million, which is one of 6 casts made by the artist. Four are housed in museums, while others are in private and foundation collections

Varchev Traders

Varchev Traders If you think, we can improve that section,

please comment. Your oppinion is imortant for us.