- Home

- >

- Stocks Daily Forecasts

- >

- Stockman: Stocks and bonds will ‘crash soon’

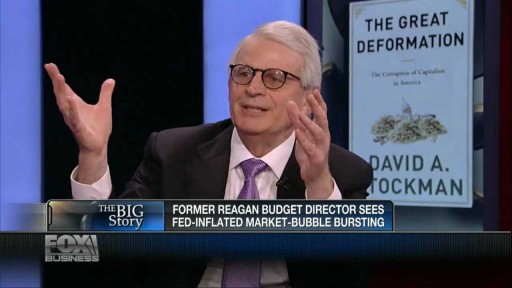

Stockman: Stocks and bonds will 'crash soon'

David Stockman has a stark warning for the world: Stocks and bonds are on the verge of a catastrophic collapse.

On CNBC's " Futures Now " Thursday, the former OMB Director said that excessive monetary policy has forced central banks all over the world into a corner, and as a result, "the markets are going to be in for a huge, nasty morning after as people begin to look at where we really are."

Stockman questioned the real strength of the economy, noting that despite the fact that the U.S. is in the midst of one of the "longest expansion or recovery periods we've had in the post-war period," we're currently in month 78 of zero interest rates. By his logic, the market has become far too dependent on the Fed.

"We saw that Wednesday when the market had another spasm upward on the suggestion that the Fed won't raise interest rates after all," said Stockman. The S&P 500 (^GSPC) hit an all-time intraday high Wednesday after Fed minutes revealed that a rate hike next month is off the table. "The market seems to want to keep chopping up all of it on the basis that maybe the Fed will give them one more month of reprieve."

But according to Stockman, all this is creating is "a coiled spring that is going to break loose one of these days and there is going to be some pretty drastic and even violent adjustment."

If history is any indication, Stockman expects a crash to happen very soon. "We seem to have them every eight years," he said. "We had one in 2000 and everyone said, 'This time was different.' Then we saw a massive catastrophic decline. Eight years later, we had the same thing," added Stockman. "Now we've had the weakest recovery in post-war history and what has happened? The Fed has simply reflated the bubble to an even more gigantic proportion."

And it's not just stocks that are in trouble. Stockman sees some troubling signs in the bond market. "It's not possible that the interest rate on the 10-year German bond (NYSE Arca: BUNL) should be 70 basis points when it was 5 just a few weeks ago-or even that the U.S. Treasurys (U.S.:US10Y) should be trading at 2 percent on the 10-year when we have taxes and inflation."

To Stockman, the message is clear, "everything is totally distorted and there is a day of reckoning coming down the pike."

Varchev Traders

Varchev Traders If you think, we can improve that section,

please comment. Your oppinion is imortant for us.