- Home

- >

- Stocks Daily Forecasts

- >

- Stocks advance with S&P 500 futures, dollar declines

Stocks advance with S&P 500 futures, dollar declines

Investors got a reprieve from the recent turmoil with stocks recovering from their worst weekly rout since 2011. The dollar fell on concernPresident Donald Trump’s budget proposal will drop a Republican Party goal to balance the budget in 10 years.

Shares in Hong Kong and China, which bore the brunt of last week’s selloff, rose as did South Korean equities after the S&P 500 Index jumped on Friday and the futures extended gains as the trading week got underway in Asia. Japan is closed for a holiday. Australian banks weighed on the benchmark there at the start of a sweeping inquiry into the nation’s financial system. Oil traded around $60 a barrel.

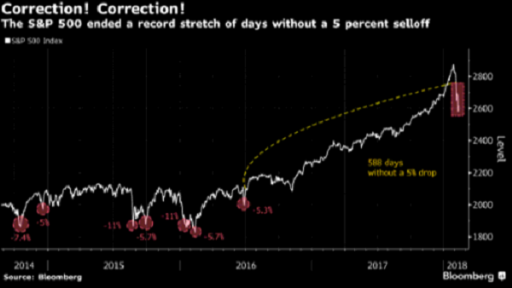

Even as U.S. stocks ended the week on a high note fears of interest-rate hikes that pushed markets into a correction persist. U.S. stocks ended their worst week in two years with the S&P 500 tumbling 5.2 percent. The Cboe Volatility Index ended almost three times higher than its level on Jan. 26. Ten-year Treasury yields finished the week at 2.85 percent, near where they started and after pushing as high as 2.88 percent.

“When we look at the Friday night action in the U.S., markets are still spinning around all over the place and so you might want to spend a bit of cash” on buying equities, said Sydney-based Stephen Miller, an adviser at Grant Samuel Funds Management. “But keep some powder dry.”

Traders are awaiting U.S. consumer price data out on Wednesday with some trepidation. The forecast for inflation is to rise by 0.2%, which is slower than in December, when consumer prices peaked for 11 months.

An increase in inflation will have a strong positive impact on the dollar, as the level of the indicator will move closer to the FED target of 2%. The steady inflation in recent months and the strong economic growth in the US are an indisputable fact and according to market participants, the Fed does not reflect this and raise interest rates as expected or more. Currently, the only worry on the market is the stock market correction, which, if deepened, will most likely cause the members of the monetary policy committee to reflect on. Despite the sharp downturn, however, many market analysts and investors are of the opinion that there is a solid foundation behind the stock, and the current adjustment is just a "breath of air."

With better forecasts for inflation, we expect a strong dollar over the week, and worse, the value of the greenback will remain.

Source: Bloomberg Pro Terminal

Jr Trader Alexander Kumanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.