- Home

- >

- Daily Accents

- >

- Stocks continue on with the rally, poor data on jobs raises bets on rate cut

Stocks continue on with the rally, poor data on jobs raises bets on rate cut

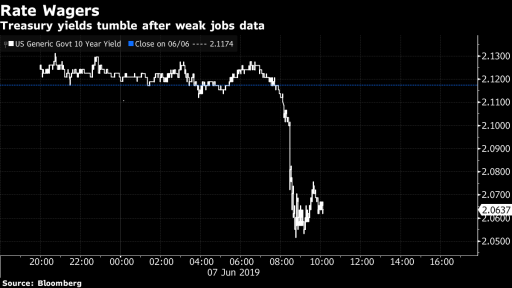

Bonds and stocks continue with the rally after weaker data on the labor market. This gave a new impetus to speculation that the Federal Reserve would cut interest rates. The US dollar has retreated today.

Yield on two-year bonds continued to decline, on track to record its longest weekly decline since 2016. This happened after the report that fewer workers were hired for the third consecutive month and wage growth slowed. Technological and consumer shares led to the best S & P500 weekly performance since November, and in addition to the positive sentiment, optimism about the possible cooling of the trade conflict has been reflected.

Traders seriously rely on rising chances that the Federal Reserve will cut interest rates after today's data. It seems that the world's largest economy is slowing down. The chairman, Powell, has signaled that the central bank seems to be open to the idea of relieving politics over trade pressure.

Investors also closely watch developments around the trade war. A representative from the White House said there is a plan to put new tariffs on Mexico since Monday. The Trump administration has also announced that it will likely delay the imposition of new tariffs on Chinese goods.

Upcoming Events: Former Theresa May is expected today to step down as leader of the Conservative Party.

S & P500 rose by nearly 0.9%, Stoxx Europe 600 posted an increase of 1%. The Japanese yen climbed 0.4%. In bonds, ten-year US government bond yields fell to 2.06%, German 10-year fell to -0.26%. British 10-year-olds reported a decline to 0.82% yield.

WTI Crude Oil Reflected today an increase of 1.6%

Суровият петрол WTI отрази днес повишение от 1.6%

Source: Bloomberg Finance L.P.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.