- Home

- >

- Fundamental Analysis

- >

- Stocks fall, bonds rise – market wrap

Stocks fall, bonds rise - market wrap

Asian stocks declined from the highest level in almost two years on concern about the appetite of U.S.

consumers to keep spending, while bonds and gold extended gains. Oil approached $48 a barrel.

Global equities are trading near a record high amid optimism the economy can weather higher U.S. interest rates.

Weak sales at American department stores underscored rising angst that the biggest part of the U.S. economy isn’t picking up pace enough to raise growth rates. U.S. retail sales data due later Friday will give investors a fresh read on the situation.

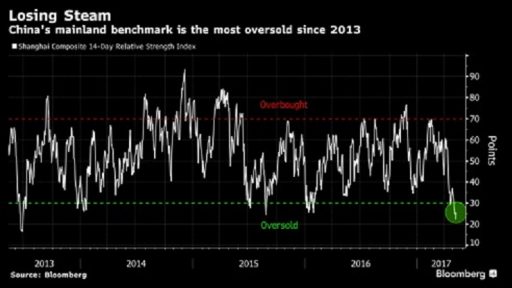

While mainland Chinese shares rebounded on Friday, they still headed for a fifth week of declines, the worst run this year. The rout has erased more than $560 billion from the value of equities, making the Shanghai Composite Index the world’s worst performer since mid-April.

In Hong Kong, the Hang Seng Index rose for a fifth straight day.

The yen rose 0.1 percent to 113.78 per dollar, paring its decline for the week to 0.9 percent.

The kiwi dollar was little changed, after tumbling to the lowest in almost a year on Thursday following dovish comments from New Zealand’s central bank.

The yield on 10-year Treasury notes was down one basis point at 2.38 percent, after falling three basis points Thursday.

Oil rose 0.2 percent to $47.92. Crude is up for a third day, leaving the worst of last week’s rout behind for now, as U.S.

stockpiles fell and two OPEC members said there’s a consensus to extend output cuts.

Gold advanced 0.2 percent to $1,226.94 an ounce after a 0.5 percent advance Thursday.

Source: Bloomberg Pro Terminal

Jr Trader Ivan Ivanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.