- Home

- >

- Daily Accents

- >

- Stocks rise to records, BoJ holds policy before ECB: Market Wrap

Stocks rise to records, BoJ holds policy before ECB: Market Wrap

Asian stocks climbed for a ninth straight day, spurred by fresh all-time highs for U.S. equities and as

the Bank of Japan maintained its mega monetary stimulus. The Australian dollar reversed an advance that saw it jump closer to 80 U.S. cents after a jobs report.

Equities from Tokyo to Sydney climbed, with the MSCI All- Country World Index trading at a record high. With the Bank of Japan delaying the time-frame for reaching its inflation target -- a sign its stimulus is in place for a long time to come -- attention now turns to the European Central Bank’s meeting for clues on policy paths. Oil held onto gains as stockpiles.

While the ECB is also forecast to keep policy on hold Thursday, a report that the bank has been examining options for asset purchases adds to speculation that Mario Draghi will concede that the time is approaching to adjust the bond-buying program as the economic recovery expands.

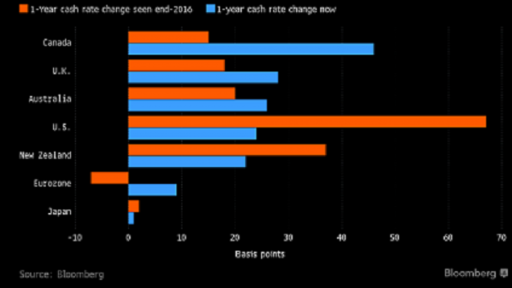

Meanwhile, U.S. benchmark bond yields are falling this week and the dollar is weaker as investors pare expectations for progress on President Donald Trump’s agenda that may have given the economy a boost. Amid fiscal uncertainty, markets have trimmed U.S. interest rate-increase expectations for the Federal Reserve to less than 50 percent by year-end despite assertions from policy makers that another hike seemed appropriate.

Stocks

Japan’s Topix index rose 0.7 percent and Australia’s S&P/ASX 200 Index climbed 0.6 percent. Hong Kong’s the Hang Seng Index added 0.3 percent, while the Shanghai Composite Index was up 0.2 percent.

S&P 500 futures were little changed after the underlying gauge rose 0.5 percent to a record 2,473.83 on Wednesday. * The VIX index closed below 10 for a record fifth consecutive day.

Currencies and bonds: The Aussie traded at 79.39 U.S. cents. It reached a two-year high of 79.89 cents after a characteristically volatile monthly jobs report for June showed a surge in full-time employment. It’s the best-performing G-10 currency this year, having climbed more than 10 percent.

The yen traded at 112.07 per dollar.

Commodities

WTI crude was flat after surging 1.5 percent on Wednesday when government data showed U.S. crude and gasoline stockpiles continue to fall, allaying anxiety about a supply glut.

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.