- Home

- >

- Fundamental Analysis

- >

- Stocks sag on Apple miss, Dollar climbs before Fed

Stocks sag on Apple miss, Dollar climbs before Fed

U.S. stock futures pointed to a downbeat opening after European shares fell from a 20-month high as investors digested poor overnight news on Apple Inc. earnings.

The dollar strengthened before a Federal Reserve meeting where policy makers will need to mull over another soft patch in the U.S. economy.

Apple Inc. fell 1.7 percent in pre-market New York trading and suppliers to the company were among the biggest losers in the Stoxx Europe 600 Index. Dialog Semiconductor Plc dropped as much as 6.2 percent before trimming losses. Industrial metals fell, pushing down commodity producers for a third day. A bond rally in Europe was led by Italy. Closed markets in Japan and Hong Kong curtailed trading in Treasuries, which weakened at the start of European hours.

Disappointment over Apple results managed to offset upbeat company earnings in Europe that has its mirror in growth data and the lowest unemployment rate in Germany since reunification.

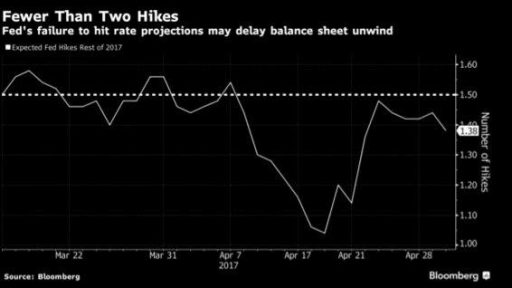

Also contributing to the tentative mood: the Federal Reserve will meet later and its statement will be parsed for clues on its tightening path. The Fed’s monetary policy hinges on whether President Donald Trump can meet fiscal stimulus pledges that will ignite inflation.

Here are key upcoming events and data releases due:

Investors will be watching comments from a policy meeting of the Federal Open Market Committee Wednesday.

The U.S. Treasury releases its quarterly refunding plans for issuance of longer term debt, which may get more attention than usual after Treasury Secretary Steven Mnuchin flagged potential interest in selling bonds with maturities beyond 30 years.

Voters in France go to the polls on Sunday for the second round of presidential elections.

Companies scheduled to release earnings this week include:

Facebook Inc., HSBC Holdings Plc, Time Warner Inc., and Royal Dutch Shell Plc.

Stocks

Euro Stoxx 600 fell 0.2 percent as of 6:47 a.m. in New York, with losses led by miners.

Futures on the Nasdaq 100 fell 0.3 percent. Futures on the S&P

500 retreated 0.1 percent after the underlying gauge rose 0.1 percent Tuesday.

Currencies

The Bloomberg Dollar Index rose 0.2 percent and the greenback gained against most of its Group-of-10 peers.

The yen weakened 0.2 percent to 112.20, extending the longest losing streak since November.

The euro fell 0.2 percent to $1.0910.

Commodities

Oil rebounded 0.9 percent following Tuesday’s 2.4 percent decline. Crude had dropped to the lowest level in more than a month after Saudi Arabia signaled it’s faring better than expected with low prices.

Gold fell 0.2 percent to $1,254.31, while copper futures declined 2.4 percent.

Source: Bloomberg

Jr Trader Alexander Kumanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.