- Home

- >

- Stocks Daily Forecasts

- >

- Stocks show impressive resilience as supply, Fed boosts yields

Stocks show impressive resilience as supply, Fed boosts yields

Bears may have lost some footing as the S&P 500 was able to end yesterday little changed despite the zig-zags in crude and Trump's decision to pull out of the Iran accord. Futures also look encouraging this morning. Watch for a continuation of the buy energy, sell yield proxy trade, my colleague Arie Shapira writes.

Nasdaq futures are slightly lagging but they look promising on their own accord. They are solidly back above the 50-DMA and the downtrend line off the March high.

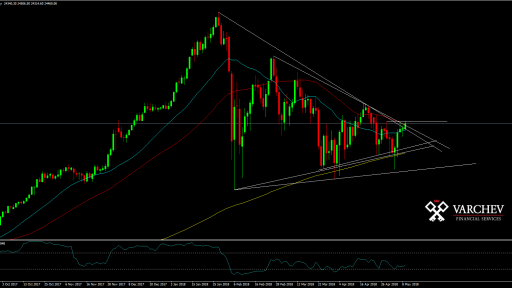

Bulls aren't firmly in charge yet. The cash S&P 500 is still unchanged for the year, its moving average convergence divergence indicator (MACD) is in a slight sell position and the percentage of stocks trading above their 200-DMA remains below 60%. A slowdown in the dollar and a sustained push of yields above 3% could trip up stocks.

It's apparently all sweetness and light this morning as U.S. equity futures have rallied nicely even as 10s hover around 3% in anticipation of today's mountainous supply of 10-year notes. If equities can hold a bid even as rates tick higher, that will clearly be an encouraging sign.

Today offers a producer-price hors d'ouevre to tomorrow's CPI main course. Thursday's inflation report will do little to cement the case for a June hike -- that's already baked in the cake -- but will go some ways in informing expectations of the cycle beyond that. It's worth noting that markets are now pricing in just shy of a 50/50 bet that the Fed hikes four times this year. In that context, perhaps the recent dollar strength isn't so surprising.

Source: Bloomberg Pro Terminal

Trader Aleksandar Kumanov

Trader Aleksandar Kumanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.