- Home

- >

- Stocks Daily Forecasts

- >

- Stocks to pop another 10% or more from here despite trade war, rising rates

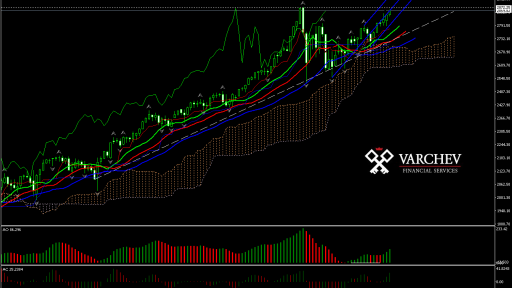

Stocks to pop another 10% or more from here despite trade war, rising rates

Wall Street's biggest bull is standing by his call that the S&P 500 will jump 12 percent by the end of 2018 as the broad market index nears highs not seen since January.

In less than five months, the index will hit 3,200 points by year's end as a healthy economic backdrop and robust corporate earnings support the historic bull market, wrote Canaccord Genuity strategist Tony Dwyer. Optimism among businesses and consumers alike, combined with continued positive quarterly results, suggest "there is a long way to go" despite persistent tariff and trade headlines, he argued.

Our "core thesis suggests any pause in the upside should be considered opportunity," Dwyer said in a note to clients Tuesday. "There is no doubt the unpredictable news backdrop of a potential trade war with China and a rise back to 3 percent in the 10-year U.S. Treasury yield can cause increased volatility, but the fundamental backdrop commands using it as an opportunity to add risk."

As the most most bullish strategist of all strategists tracked in CNBC's regular survey, Dwyer expects the S&P 500 to rally well beyond its all-time high of 2,872.87, which it clinched on Jan. 26. A spike in market volatility based on fears of higher borrowing costs sent the major stock indexes tumbling more than 10 percent from those benchmarks earlier this year before anxieties surrounding rampant inflation calmed.

Source: CNBC

Trader Aleksandar Kumanov

Trader Aleksandar Kumanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.