- Home

- >

- Trading University

- >

- Strategy “Trend trade”

Strategy "Trend trade"

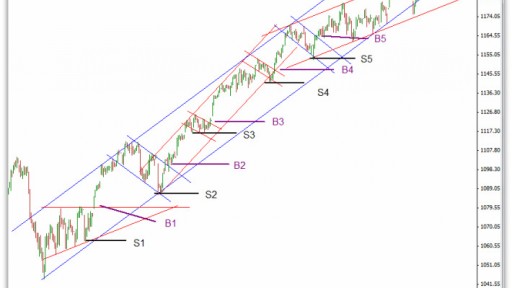

echnical analysis often seems difficult for new traders who may not have a mathematical inclinations. But the reality is that forex traders do not need a PhD to implement this strategy. Trend Strategy is one of the most common techniques used by its nature is to take advantage of the momentum that is usually present in the market.

According to recent reports from Juno Markets, the trend is available in the Forex market approximately 70% of the time. This is important since it shows that the prices move in a given direction and tend to continue to move in the same direction. But that does not mean the trend will always continue. The trend can not last forever and there will inevitably be cases where open positions in the direction of the trend and will fail. But this should not deter traders will have many opportunities to exploit the trend and realize the profits that can be seen over time.

Transactions of the trend strategies are implemented in the longer term, so if you're living a trader who successfully used short-term trading strategies that certainly can not be the right approach. But if you're new to Forex traders who have dostaachno time to monitor the market, trend trading can be just what you are looking for ..

The main advantage of strategies for trend trading is that forex trader will know that the majority of market movement / 70% / in favor of your position. This is not something that can be said for other strategies. Trend can occur only if the majority of market participants believe that prices should move in a certain direction. So when we sell, so we can expect that we will achieve profitability in the majority of cases

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.