- Home

- >

- Daily Accents

- >

- Stronger European markets, but the risks of Brexit and Italy remain (29.08.2018)

Stronger European markets, but the risks of Brexit and Italy remain (29.08.2018)

Sources close to the Brexit negotiations between the UK and the EU told Bloomberg that they expect the negotiations to reach an agreement by the middle of November, rather than October as is officially planned. The official Brexit date is March 29th. After the release of the news, the pressure on the pound strengthened. On the 4-hour chart, GBP/USD forms a double top just beneath the 1,3 resistance level, which confirms the strong resistance at that level:

We will track GBP/USD for a break below 1,28. Below 1,28 we believe that the overall downwards trend will continue, which makes it attractive for opening short positions.

S/L: 1,2827

Yesterday Stoxx 600 rose 0,3%, led by automobile and mining shares. The optimism of the markets was strengthened by the S&P500 all-time high, as well as due to a potential resolution of trade conflicts after the US-Mexico trade deal. As the chart from Bloomberg shows, the Stoxx 600 broke above the 50- and 200-day MA:

The effects of a stall in Brexit negotiations and weak economic growth in France (1,7%) can bee seen on EUR/USD:

On the 4-hour chart we see a failed attempt to break out above 1,17. The attempt is unsuccessful and the price returns below 1,165. The failed break out is supported by the DeMarker, which indicates a weakening of the trend. The key support level here is 1,165. At this point we find opening positions on EUR/USD as too risky.

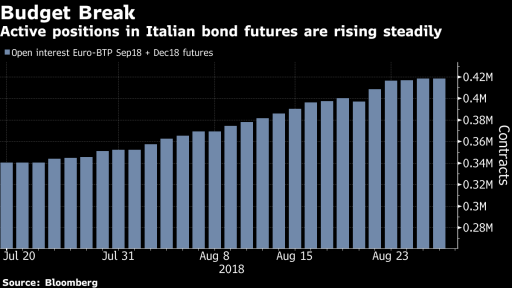

In the mid-term we believe the euro will be pressured by the risks posed by Italy. BTP futures have seen a rise in open interest of 80,000 in the past one month:

The 25% increase in open interest in Italian BTP futures in the past month can cause a panicked sell-off in BTPs in periods of volatility and turbulence in European markets. This will naturally be amplified by the increased open interest in the futures.

In European business, Pernod Ricard SA, the second largest alcohol distiller in the world, announced higher expectations for earnings for 2H 2018 after a 9-year strong sales streak by Jameson and good performance in India and China. The company also raised its dividend 17%.

The legendary carmaker Aston Martin is planning an IPO. The final decision will be made by 20th of September.

Renault SA announced a new SUV crossover called Renault Arkana, which will target mainly the Russian market. The company sees Russia as its biggest market by 2022.

Source: Bloomberg Finance L.P.

Charts: Used with permission of Bloomberg Finance L.P.

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.