- Home

- >

- FX Daily Forecasts

- >

- Supports and resistances on the major currency crosses

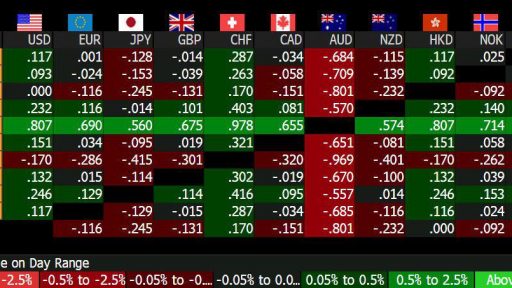

Supports and resistances on the major currency crosses

USD/JPY

3rd resistance: 112.87, ichimoku cloud top

2nd resistance: 112.69, 61.8% Fibonacci of March-April fall

1st resistance: 112.31, ichimoku cloud bottom

Spot: 112.15

1st support: 111.78, May 2 low

2nd support: 111.18, May 1 low

3rd support: 110.88, April 26 low

AUD/USD — Bears in control after winning over 200-DMA

battle with bulls, in post-RBA price action

3rd resistance: 0.7592, April 24 high

2nd resistance: 0.7572, April 25 high

1st resistance: 0.7546-56, Asia high, May 2 high

Spot: 0.7490

1st support: 0.7484, 61.8% Fibonacci of April 27 rise

2nd support: 0.7467-62, 76.4% Fibonacci, May 1 low

3rd support: 0.7440, April 27 low

EUR/JPY — Breaks down-trendline dating back to mid-December

3rd resistance: 123.16, Jan. 30 high

2nd resistance: 122.89, March 13 high

1st resistance: 122.63, March 14 high

Spot: 122.50

1st support: 122.09, May 1 high

2nd support: 121.86, May 2 low

3rd support: 121.31, May 1 low

EUR/USD — Overlapping sessions against 1.0934 Fibonacci

warns at downside corrective risks

3rd resistance: 1.1070-74, weekly cloud, 76.4% Fibonacci

2nd resistance: 1.0995, 100-week MA

1st resistance: 1.0951-54, April 26, Nov. 10 high

Spot: 1.0919

1st support: 1.0852, April 27 low

2nd support: 1.0834, 200-DMA

3rd support: 1.0821, April 24 low

GBP/USD — Flat ichimoku conversion line at 1.2861 provides

springboard as risks keep mounting for 1.30 breakout

3rd resistance: 1.3023, Sept. 30 high

2nd resistance: 1.2990, pivot r2

1st resistance: 1.2966-69, May 1 high, 55-week MA

Spot: 1.2922

1st support: 1.2865-61, May 2 low, ichimoku line

2nd support: 1.2839, April 27 low

3rd support: 1.2805, April 26 low

EUR/GBP — Tuesday’s Doji session against 21-DMA could

prompt re-test of gap zone 0.8405-0.8387

3rd resistance: 0.8531, April 26 high

2nd resistance: 0.8496, April 27 high

1st resistance: 0.8485, May 2 high

Spot: 0.8449

1st support: 0.8423, May 2 low

2nd support: 0.8405, April 28 low

3rd support: 0.8387, April 21 high

USD/CHF — Consolidates inside large range of April 24

3rd resistance: 1.0000-09, April 21 high, April 13 low

2nd resistance: 0.9967, May 2 high

1st resistance: 0.9928, May 1 low

Spot: 0.9909

1st support: 0.9894, April 28 low

2nd support: 0.9856, April 24 low

3rd support: 0.9832, March 28 low

Varchev Traders

Varchev Traders If you think, we can improve that section,

please comment. Your oppinion is imortant for us.