- Home

- >

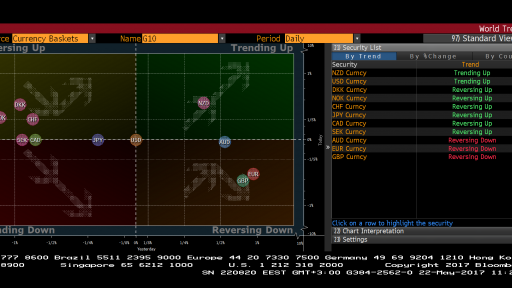

- FX Daily Forecasts

- >

- Supports and resistances on the major currency pairs today, 22.05.2017

Supports and resistances on the major currency pairs today, 22.05.2017

AUD/USD -- 0.7472 big hurdle for bulls

3rd resistance: 0.7502, 76.4% Fibonacci of May drop

2nd resistance: 0.7480, May 3 mid open/close price

1st resistance: 0.7470-72, May 19 high, 61.8% Fibonacci

Spot: 0.7458

1st support: 0.7435, Asia low

2nd support: 0.7407, May 19 low

3rd support: 0.7389-85, May 17, 15 low

EUR/USD -- Next meaningful resistance not until 1.1300

3rd resistance: 1.1300, Nov. 9 high

2nd resistance: 1.1246, pivot r1

1st resistance: 1.1212, May 19 high

Spot: 1.1173

1st support: 1.1154, May 19 mid open/close price

2nd support: 1.1097, May 19 low

3rd support: 1.1076, May 18 low

GBP/USD -- Bulls remain in control; rising 21-DMA (1.2918) provides training risk line

3rd resistance: 1.3139, Sept. 14 low

2nd resistance: 1.3121, Sept. 22 high

1st resistance: 1.3048-59, May 18, Sept. 29 high

Spot: 1.3002

1st support: 1.2927, May 19 low

2nd support: 1.2900, May 18 low

3rd support: 1.2866, May 16 low

EUR/JPY -- Maintains offensive posture while above 21-DMA

3rd resistance: 125.82, May 16 high

2nd resistance: 125.40, May 17 high

1st resistance: 125.05, 76.4% Fibonacci of May 16 drop

Spot: 124.55

1st support: 124.11, May 18 high

2nd support: 123.39, May 19 low

3rd support: 123.10, 21-DMA

USD/JPY -- Flat ichimoku baseline at 111.25 provides support on closing basis as fresh rally risks mounting

3rd resistance: 112.40, May 8 low

2nd resistance: 111.82, ichimoku cloud top

1st resistance: 111.71, 55-DMA

Spot: 111.32

1st support: 110.24, May 18 low

2nd support: 109.83, 200-DMA

3rd support: 109.60, 76.4% Fibonacci of April/May rise

USD/CHF -- Rally attempts likely to attract selling interest

3rd resistance: 0.9848, May 16 low

2nd resistance: 0.9824, May 17 mid open/close price

1st resistance: 0.9805, May 19 high

Spot: 0.9752

1st support: 0.9724, Asia low

2nd support: 0.9702, pivot s1

3rd support: 0.9674, pivot s2

EUR/GBP -- Dithers around 200-DMA at 0.8596

3rd resistance: 0.8776, 76.4% Fibonacci of March/April

2nd resistance: 0.8662, March 30 high

1st resistance: 0.8618-24, March 28, 29 low

Spot: 0.8602

1st support: 0.8589, daily pivot

2nd support: 0.8569, May 19 low

3rd support: 0.8524, May 18 low

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.