- Home

- >

- FX Daily Forecasts

- >

- Technical levels on the major currency pairs

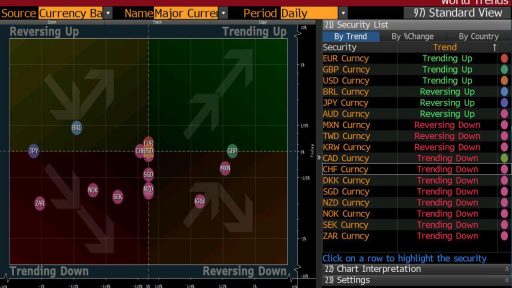

Technical levels on the major currency pairs

USD/JPY -- Continues to consolidate between 110.00/111.60

3rd resistance: 112.20 March 31 high

2nd resistance: 111.57 Elliott minor wave

1st resistance: 110.94 April 4/11 high

Spot: 110.40

1st support: 110.27 April 4 low

2nd support: 110.00 psychological level

3rd support: 109.93 cloud base/Fibo retracement

EUR/USD -- Higher for a test toward 100-DMA

3rd resistance: 1.0689 April 5 high

2nd resistance: 1.0662 50-DMA

1st resistance: 1.0624 100-DMA

Spot: 1.0613

1st support: 1.0570 April 10 low

2nd support: 1.0558 March 7 low

3rd support: 1.0525 March 9 low

GBP/USD -- Consolidating gains above multiple DMAs

3rd resistance: 1.2506 April 6 high

2nd resistance: 1.2478 April 7 high

1st resistance: 1.2450 April 6 low

Spot: 1.2433

1st support: 1.2377 March 29 low

2nd support: 1.2351 April 10 low

3rd support: 1.2324 March 17 low

USD/CAD -- Lower toward multiple DMA supports

3rd resistance: 1.3426 April 10 high

2nd resistance: 1.3398 April 6 low

1st resistance: 1.3342 April 7 low

Spot: 1.3322

1st support: 1.3287 100-DMA

2nd support: 1.3274 50-DMA

3rd support: 1.3220 200-DMA

AUD/USD -- Higher toward 100-DMA

3rd resistance: 0.7577 April 5 high

2nd resistance: 0.7553 200-DMA

1st resistance: 0.7515 100-DMA

Spot: 0.7509

1st support: 0.7476 April 10 low

2nd support: 0.7449 Jan. 13 low

3rd support: 0.7430 Jan. 12 low

NZD/USD -- Consolidating losses within downtrend below 0.7000

3rd resistance: 0.7050 March 28 high

2st resistance: 0.7022 April 4 high

1st resistance: 0.6994 April 7 high

Spot: 0.6945

1st support: 0.6921 April 10 low

2nd support: 0.6894 March 14 low

3rd support: 0.6872 Dec. 26 low

EUR/JPY -- Resuming downtrend below 200-DMA

3rd resistance: 118.79 April 5 high

2nd resistance: 118.07 April 10 high

1st resistance: 117.82 200-DMA

Spot: 117.13

1st support: 116.75 Nov. 18 low

2nd support: 116.52 Nov. 16 low

3rd support: 116.26 Nov. 17 low

EUR/GBP -- Consolidating losses below multiple DMAs

3rd resistance: 0.8594 200-DMA

2nd resistance: 0.8587 50-DMA

1st resistance: 0.8556 100-DMA

Spot: 0.8536

1st support: 0.8511 April 6 low

2nd support: 0.8496 233-DMA

3rd support: 0.8461 Feb. 27 low

Source: Bloomberg

Junior Trader Ivan Ivanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.