- Home

- >

- Stocks Daily Forecasts

- >

- Tesla has redeemed the hopes of the bulls again – what’s next

Tesla has redeemed the hopes of the bulls again - what's next

Hardly anyone would expect a car company to ignore even the slightest security test, and what remains for the mandatory braking tests that each car produced passes immediately after the production line. Well, in an effort to reach the promised volume of production, Tesla also ignored this type of test.

Tesla has always said that every car is tested in real terms. "We drive every Model on our test track to test the brakes, torque, control and performance of all components."

Earlier yesterday, however, the company was in a different opinion, saying that "the tests are totally unnecessary."

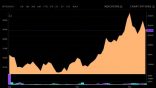

The technical price is a wide range between $250 and $350, after the announcement that the company is suspending Model 3 brake tests, the stock price collapsed by over 14% in two days. Currently, no adequate levels of purchasing are available, but in the long run it is good to consider two levels of support. The first level of support where the price is likely to hold is the area formed by the inner diagonal (green line) and 38.2% Fibonacci correction. That's where the more aggressive traders will position themselves with long positions. A more conservative trade requires a price correction of up to 50% of the main trend and the presence of diagonal and horizontal support. Such are available in the area around $250. I expect the price to be adjusted precisely to where the takeover will require SL under the previous floor.

SL: $225

Alternative Scenario: If the price goes below the main diagonal and stays there in several successive bars, a long-term positive scenario will be spoiled and more likely to observe a decline in stock prices.

Chart: Used with permission of Bloomberg Finance L.P.

Trader Petar Milanov

Trader Petar Milanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.