- Home

- >

- Great Traders

- >

- The 10 highest paid hedge fund managers for 2018

The 10 highest paid hedge fund managers for 2018

Despite the tricky year for the stock markets and hedge fund managers generally, some of the biggest names in the industry have earned a total of $7.7 billion in 2018.

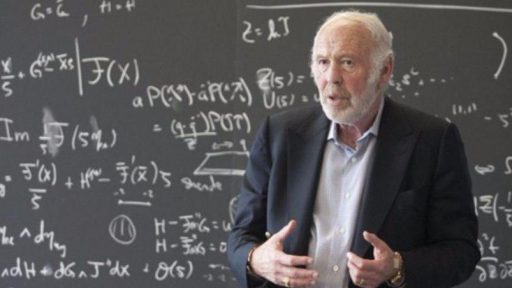

James Simon of Renaissance Technologies wins the first place. The former code-breaker's fund earned an insane $1.6 billion in income last year, increasing his net worth to $16.6 billion.

It is not a surprise that the hedge fund titan Ray Dalio is in the top 10 for 2018 with an income of $1.26 billion with his flagship Pure Alpha fund gaining 14.6% last year. His own fortune rose alongside Bridgewater Capital's approximate $160 billion of assets.

Citadel's Ken Griffin was in the news after the hedge-fund manager paid $240 million for a New York penthouse, right after picking up a London mansion for $122 million. But these numbers can't compare to the $870 million he brought in for 2018, taking his own personal fortune to approximately $10 billion.

The fourth and fifth highest earners were Two Sigma founders John Overdeck and David Siegel. Their fund got each of them around $770 million in renumeration in 2018.

Bluecrest's Michael Platt was the sixth highest earner, with $680 million. His fund returned a massive 25%. Meanwhile, David Shaw of D.E Shaw's multi-strategy fund brought in $590 million.

Element Capital Management's Jeff Talpins became a billionaire for the first time in 2018 after his fund earned $420 million with a return of 17%.

Chase Coleman of Tiger Global Management has a venture capital arm which helped to boost his fortune to $3.9 billion after earning $370 million in 2018.

The 10th position is for Izzy Englander of Millennium, whose fund brought him in $340 million for last year.

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.