- Home

- >

- Daily Accents

- >

- The 30 minutes that have an outsized role in US stock trading

The 30 minutes that have an outsized role in US stock trading

The increasing concentration of buying and selling of US stocks in the final 30 minutes of the day has some investors calling for a shorter trading period to help limit the market’s growing operational risk.

A seismic shift towards exchange traded funds and other index-tracking investment vehicles has heightened the importance of the last half-hour of the US trading day, from 3.30 to 4pm, when these passive funds typically conduct most of their activity to accurately match their benchmarks. That has prompted traditional active managers to conduct more of their trading during this window to benefit from greater market “liquidity”.

“This dynamic is a pretty big story,” said Bob Minicus, head of global equity trading at Fidelity. “We view the close as an opportunity. As more volumes migrate towards the close, we will follow it.”

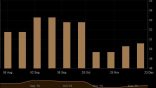

Some traders and investors complain that the funnelling of activity into the last half-hour of the day — which comprises nearly a quarter of all US stock trading — is sucking liquidity away from the middle of the day, when making large trades can now have a noticeable market impact.

Indeed, what traders refer to as the “liquidity smile” formed by the pattern of trading volumes has recently become more pronounced and turned it into a “liquidity smirk” due to the lopsided importance of the 3.30-4pm trading window. Some now fret that, with so much money sloshing around in a small window, it increases the risks of market mishaps.

Please use the sharing tools found via the email icon at the top of articles. Copying articles to share with others is a breach of FT.com T&Cs and Copyright Policy. Email licensing@ft.com to buy additional rights. Subscribers may share up to 10 or 20 articles per month using the gift article service. More information can be found at https://www.ft.com/tour.

https://www.ft.com/content/9e1f05b4-43e7-11e8-803a-295c97e6fd0b

“A lot of trading is concentrated in a very narrow period of time,” said Marco Pirondini, head of US equities at Amundi Pioneer Asset Management. “It can be a very big technical problem. I would love regulators to start to think about this before there’s a problem, rather than after one.”

Sucking more liquidity away from midday trading heightens the risk of making markets more prone to volatility around lunchtime. The share of US stock trading that happens between noon and 2pm has dipped from more than 23 per cent a decade ago to about 20 per cent, according to Credit Suisse. Given the clear trajectory of the trend, more midday volatility could start to become more apparent in the coming years.

“It’s become a self-fulfilling prophecy. The liquidity feeds on itself,” said Todd Lopez, head of electronic trading for the Americas at UBS. “The concentration around the close is likely to accelerate as more people try to minimise their market impact.”

There have already been some examples that the thinner midday trading can cause problems, most notably the “flash crash” of 2010, when the US stock market suddenly swooned at 2.45pm. While the blame fell primarily on a badly executed order by a big asset manager that was exacerbated by high-frequency trading, some experts say the severity was worsened by the thinner early-afternoon liquidity.

Please use the sharing tools found via the email icon at the top of articles. Copying articles to share with others is a breach of FT.com T&Cs and Copyright Policy. Email licensing@ft.com to buy additional rights. Subscribers may share up to 10 or 20 articles per month using the gift article service. More information can be found at https://www.ft.com/tour.

https://www.ft.com/content/9e1f05b4-43e7-11e8-803a-295c97e6fd0b

The first and last half-hour of the US trading day now accounts for 39.6 per cent of all volumes, up from 31.5 per cent a decade ago, according to Credit Suisse data. A decade ago about 16 per cent of all trading happened in the final 30 minutes, but that rose to more than 20 per cent in 2012, and almost 25 per cent this year. The closing auction alone — when most ETFs do their rebalancing — now accounts for 8.2 per cent of volumes in 2018, up from 3 per cent in 2007.

Closing auctions in shares are mostly held at a company’s primary listing venue, concentrating liquidity at Nasdaq and the New York Stock Exchange.

“It does come with increased operational risk,” Mr Lopez said. “If an exchange has an issue, it’s already quite disruptive, but as more trading happens at the close the risks become potentially much worse.”

Source: Financial Times

Trader Aleksandar Kumanov

Trader Aleksandar Kumanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.