- Home

- >

- Commodities Daily Forecasts

- >

- The bad sentiment for oil have yet to grow

The bad sentiment for oil have yet to grow

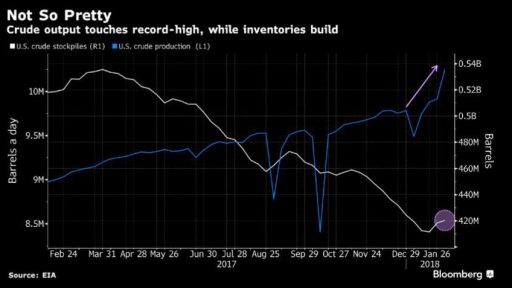

Oil has reported its biggest loss in the past two months, after the US high-yielding hit a new peak, fully covering OPEC+ efforts to balance the oil market. WTI futures are trading at a 3.06% decline, as it has now become clear that US drilling has jumped to 10.25m barrels a day.

What these numbers mean? In a nutshell, 10.25m barrels a day place the United States to one of the world's largest oil producers, Saudi Arabia, which earns an average of about 10m per day and Russia at 10.98m per day. Over the last six years, US oil production has increased by 78%, with the main contributors to this being the shale deposits that began operating during this period. Originally, shale oil technology was profitable at a WTI price of $55 a barrel, but after recent improvements, yields were gaining a barrel price over $45.

What to expect?

The production report published today by the US Energy Ministry was surprisingly revised and the US yield forecast adjusted. The ministry's expectations are extremely positive, with US mining reaching 11m barrels a year earlier than expected in November this year. This puts a huge question on the OPEC+ agreement and the already exiting treasury of producer countries.

If we compare the chart of US production, which has made it clear that it will grow, we will see with stocks that stocks have something to catch up with. US stocks have a very strong impact on oil prices and if we see stock growth again to levels above 10m barrels, WTI will have a significant foundation to drop below $50.

Looking at the CBOE and NYMEX futures markets, there is a significant increase in volatility. Clearly technically increased activity by investors at key levels means that the reversal is very likely. Taking this into consideration and the strong foundation described above, we expect a decrease in the price of black gold.

Source: Bloomberg Pro Terminal

Jr Trader Petar Milanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.