- Home

- >

- FX Daily Forecasts

- >

- The Bank of England might surprise markets with a faster increase in interest rates

The Bank of England might surprise markets with a faster increase in interest rates

The Bank of England (BOE) might surprise markets with a faster increase in interest rates than is currently expected, a member of the central bank's Monetary Policy Committee told.

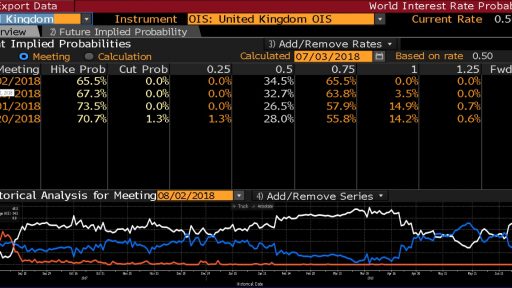

Market players have priced in a little bit more than one rate hike over the next 12 months. But, according to the BOE's Michael Saunders, this might be too cautious.

"If the economy plays out as I expect, it may be that rates need to go up a little faster than that," Saunders told in reference to market expectations.

Saunders, who's described as one of the more hawkish members of the central bank and actively votes for rate hikes, also said: "My expectation, conditioned on Brexit unfolding in sort of a smooth and gradual way, the economy will continue to grow at around the pace we have seen over the last couple of years ... (I) expect the jobless rate to fall a little further; and pay growth will pick up a bit.”

“Against that background, I think that yes, rates might need to rise a little faster," he added.

At the bank's last meeting in June, members decided to keep rates unchanged at 0.5 percent. However, the details of the decision showed that three out of the nine policymakers were in favor of a rate increase to 0.75 percent.

Some analysts believe that this split vote could mean a rate increase as early as next month.

However, Saunders highlighted that even if rates go up at a faster pace than markets expect, this will be done in a gradual way.

Chart: Used with permission of Bloomberg Finance L.P.

Trader Georgi Bozhidarov

Trader Georgi Bozhidarov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.