- Home

- >

- Daily Accents

- >

- The Bank of England will need to see more than just a spike in inflation before it raises interest rates

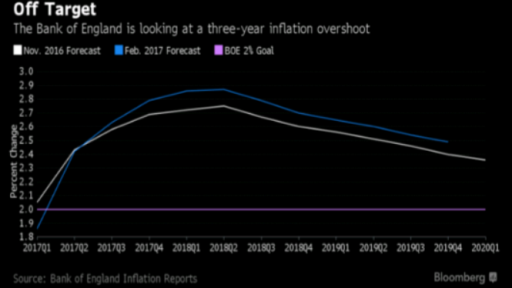

The Bank of England will need to see more than just a spike in inflation before it raises interest rates

While consumer-price growth is accelerating more than the BOE projected, Vlieghe said there’s no mechanical link to higher borrowing costs. The surge may just mean the impact of the pound’s sharp decline since the Brexit vote is hitting home faster and could, potentially, fade faster as well.

“If inflation expectations remain anchored, the fact that the peak is higher isn’t necessarily a signal that policy needs to be tighter,” Vlieghe said in an interview in London on Wednesday. “If the peak is higher it may simply mean that the pass-through is happening quicker.”

Vlieghe’s comments reinforce the idea that some traders may have overreacted to faster-than-forecast inflation and news that one of the nine Monetary Policy Committee members voted to hike the benchmark interest rate.

Inflation jumped to 2.3 percent in February, the fastest since 2013 and the fifth month since the EU referendum in June.

Policy makers are also watching wage growth for signs of underlying inflation pressure. In February, Governor Mark Carney said the consensus on the rate-setting panel is now that the unemployment rate can drop to about 4.5 percent.

The jobless rate slipped to 4.7 percent in January, the lowest since 2005.

While the BOE is watching Brexit developments, it’s focusing more on how people react to them rather than the news itself, Vlieghe said. Whatever new arrangements the U.K. works out with its European trade partners, the bank will be focused on the impact on supply, demand, and, “crucially, what happens to the exchange rate.”

Source Bloomberg

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.