- Home

- >

- Cryptocurrencies / Algotrading

- >

- The Bitcoin rally shows signs of slowing down

The Bitcoin rally shows signs of slowing down

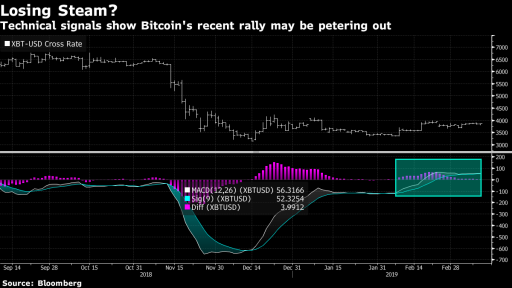

It seems that Bitcoin's rally is starting to lose momentum. Technical indicators signaled the loss of long-term buy-in, indicating that there was potential potential pressure on vendors to return again.

Bitcoin managed to record a good positive series, rising above its 52-week low, but by mid-February we are starting to see convergence in the MACD indicator.

The size of day-to-day growth has also fallen from February to early March, indicating that the rally has begun to worsen. Bitcoin reached $ 4000, but until it breaks through, the price will feel the strong bearish pressure.

Sentiment is getting worse again, and analyst Mike McGlone of Bloomberg says digital currencies are about to take down again. The conditions are similar to those of November 2018, just before the collapse. The price consolidates in a fairly narrow range, with several sharp bumps rallying down very quickly.

Still, Bitcoin's growth of 20% over the past three months is not a sign of poor performance. It means that investors are currently looking for development potential for some of the smaller digital tokens. We are approaching the culmination of Crypto Winter and we are seeing that more and more altcoins have been reporting an impressive rally over the past few weeks. We are entering a period that the industry calls alt-season.

Ether, which is the second largest digital asset since Bitcoin, has risen by more than 60 percent since mid-December. Litecoin climbed nearly 150 percent, and Bitcoin grew 23 percent.

Source: Bloomberg Finance L.P.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.