- Home

- >

- Daily Accents

- >

- The Bull Market Is Charging Into 2020

The Bull Market Is Charging Into 2020

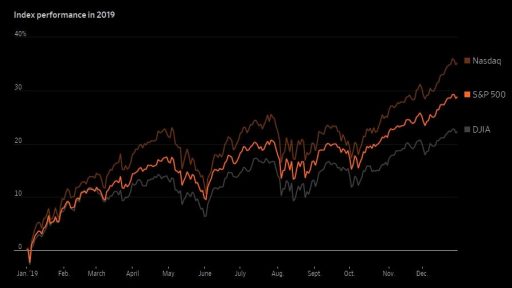

Index performance in 2019

Stocks around the world closed out one of their best years over the past decade, defying money managers who began 2019 expecting the bull market to be upended by threats from the U.S.-China trade fight and a slowdown in growth.

Just 12 months ago, the mood was far dimmer. The global economy was weakening, stocks, bonds and commodities were falling in tandem and money managers worried the Federal Reserve’s interest-rate increases would turn an economic slowdown into a protracted downturn.

Fast forward to the final day of the decade, and stock indexes from the U.S. to Brazil to Germany were up more than 20% apiece for 2019. While prior such runs have been met by skepticism, this time, few see the rally ending soon.

The Dow Jones Industrial Average’s more than 170% rise from 2010 to 2020 ranks as just the fourth-best decadelong performance in the past 100 years—a gain that, while respectable, doesn’t conjure the fear of excess that rallies in the 80s and 90s did. Many investment banks forecast solid, if modest, gains for the coming year, citing central banks’ easy-money policies, a resilient U.S. economy and a breakthrough in Washington-Beijing trade talks.

BMO Capital Markets and Goldman Sachs estimate the S&P 500 will end 2020 at 3400, 5.2% above where the index closed Tuesday, while Citigroup and Bank of America have put their target at 3300.

“I surely wouldn’t expect a repeat as far as the magnitude of market gains, but I think we’re set up for a better year in 2020 than we were in 2019,” said Dan Miller, director of equities at GW&K Investment Management.

He added that he hopes that the combination of lower interest rates and cooling trade tensions will help sustain stock gains in the new year.

On the final trading day of 2019, the S&P 500 edged up 0.3% to 3230.78, while the Dow Jones Industrial Average added 0.3% to 28538.44 and Nasdaq Composite added 0.3% to 8972.60.

he S&P 500 finished the year up 29% for its best showing since 2013, while the Dow added 22% and the Nasdaq advanced 35%.

Elsewhere, the Stoxx Europe 600 finished the year up 23% for its biggest gain since 2009, and the Shanghai Composite climbed 22%.

Hong Kong’s shares lagged behind global indexes, with the Hang Seng Index ending the year up 9% after months of clashes between antigovernment demonstrations and police.

“Despite a tricky macro backdrop, it’s been a very, very good year for global markets,’’ said Emma Wall, head of investment analysis at Hargreaves Lansdown.

Many say it is difficult to pinpoint what exactly could trip up the rally in 2020.

There are a number of uncertainties that investors say they will be watching: The U.S. and China haven’t completed a trade deal yet, the U.K. is set to leave the European Union at the end of January and there is a U.S. presidential election in November.

S&P 500 yearly performance

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.