- Home

- >

- Cryptocurrencies / Algotrading

- >

- The Crypt Maniacs still believe that BTC will hit $20K before the end of 2019.

The Crypt Maniacs still believe that BTC will hit $20K before the end of 2019.

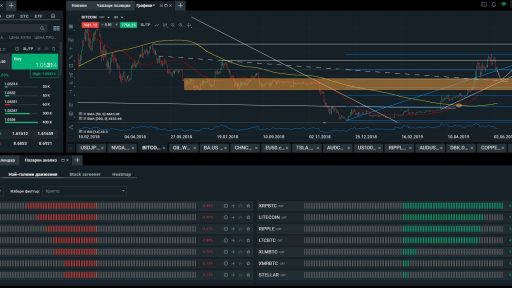

Bitcoin (BTC) bulls have failed to keep up the pressure. In a matter of one week, the leading cryptocurrency has shed 15% of its value, falling from $9,100 to $7,800 in a move uncharacteristic of the overarching uptrend. This rapid collapse has placed BTC under some tough conditions from a technical standpoint.

In fact, Bloomberg recently reported that the GTI Vera Convergence-Divergence indicator has issued a sell signal for the first time since April, which preceded a short-term sell-off in the $5,000 region. This, per the outlet, suggests that “there could be further downside as Bitcoin halts its recent monster rally.”

Some analysts, however, have remained entirely bullish. These optimists tell harrowed investors to zoom out, adding that they should focus on the fundamentals, which are what will drive digital assets higher at the end the day.

In a recent interview with lifestyle publication The Independent, Oliver Isaacs, an industry analyst, explained that Bitcoin has the “potential to hit $25,000 by the end of 2019 or early 2020.” A rally to $25,000 by the end of 2019 would see BTC rally by 224% in six months’ time, which, if you’re aware of the crypto market’s history, is entirely plausible.

Isaacs looks to the fact that there have been a number of fundamental catalysts behind this move, pointing a finger at the U.S.-China trade war as a catalyst for the growth of Bitcoin, widely deemed a safe haven or hedge asset in spite of its volatility and youth.

Isaacs isn’t the first to have an inkling of a feeling that BTC could set new records in the coming six or seven months. Speaking with Bloomberg TV last week, Jehan Chu, said he expects for BTC to hit $30,000 by December 2019. He notes that households names in Silicon Valley and on Wall Street are effectively endorsing the technology behind crypto assets, which should catalyze investor interest.

All this might not be possible this soon, though. Simply put, Bitcoin rallying to $20,000 in the coming months would invalidate the asset’s cyclicality, which shows that BTC doesn’t register a new all-time high until the block reward reduction, slated to arrive in May 2020.

Trader Georgi Bozhidarov

Trader Georgi Bozhidarov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.