- Home

- >

- Fundamental Analysis

- >

- The debt accumulated in the US car market is causing fear of a subprime

The debt accumulated in the US car market is causing fear of a subprime

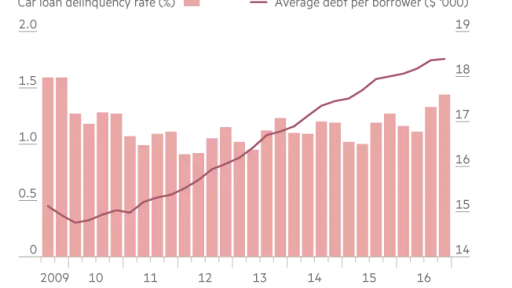

In echo to the housing market crash, US auto loan delinquencies are rising against the allegations of mis-selling.

Car dealers seem to sell cars on a leasable basis without being interested in whether buyers could pay their fees in a long-term . The risky loans are increasing and more dealers have stretched out terms, moving from the standard 60-month contract to 72 or even 84, meaning that borrowers are likely to stay “underwater” on their loans for longer. At the same time, dealers have cranked up loan-to-value ratios and debt-to-income ratios, putting borrowers under greater strain.

Just as with mortgages, the car loan business has grown rapidly. Total auto loans outstanding came to $1.17tn at the end of the first quarter of this year, according to the New York Federal Reserve, up almost 70 per cent since a post-crisis trough in 2010.

Carmakers are now boosting discounts and cutting production to address rising inventories on dealer lots. Falling used car values, in turn, are pushing up defaults, as people find themselves stuck in loans they cannot afford but can’t trade out of because they still owe more than the vehicle is worth.

According to Morgan Stanley, the share of auto securities tied to “deep subprime” loans — those given to borrowers with scores below 550 on the commonly-used FICO creditworthiness scale — rose from 5.1 per cent of total subprime deals in 2010 to 32.5 per cent last year.

A flood of used cars has hit the market, depressing prices, and many more are on the way. Another 7m or 8m cars will come off-lease by the end of next year, according to Morgan Stanley estimates, which is about twice the long-term average. The combination of higher defaults on the loans and lower recoveries on the cars could be “painful” for the banks, says Brian Foran, analyst at Autonomous Research in New York.

Source: FT

Jr Trader Ivan Ivanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.