- Home

- >

- Daily Accents

- >

- The deficit of Italy, knocking down the euro

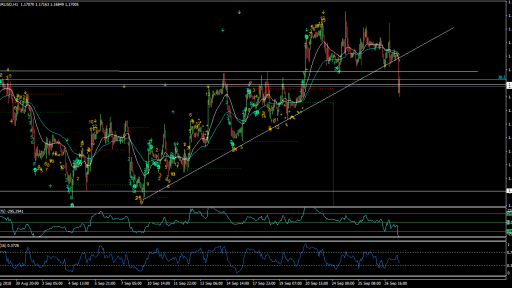

The deficit of Italy, knocking down the euro

The euro is under pressure on Thursday morning after media reports suggested that Italy's coalition government is pushing for a deficit of 2.4 percent for 2019.

The market instability comes amid disputes within the coalition government over its spending plans. Rome is putting together its 2019 budget — a key document for market players as they look for certainty regarding the future spending plans of the new government.

Italian media reports suggested Thursday that Tria could be forced to resign if he does not deliver all the promises that the two populist parties made. There are also some concerns the budget's presentation could be delayed.

Markets await deficit figure

The Italian government is due to meet later today to discuss and announce new budget targets. But the specific details of the 2019 budget will not be known until some time in October.

Thursday's budget targets will be the first signal of what the Italian government wants to do. While both political parties within the coalition said Wednesday they want a deficit of 2.4 percent of GDP, the finance minister is reportedly pushing for a deficit of 1.6 percent.

Last month, analysts at Bank of America had warned that 2 percent is the "watershed level" — meaning that if the deficit is higher than this threshold there could be some negative market reaction. On the other hand, if Rome surprises with a deficit lower than 2 percent, there could be a rally in Italian assets.

Italian banks have been under pressure since late April on the back of higher borrowing costs. This is because Italian banks hold about 18 percent of the country's sovereign bonds.

Source: CNBC

Trader Georgi Bozhidarov

Trader Georgi Bozhidarov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.