- Home

- >

- Daily Accents

- >

- The divergence between USD and US inflation, may to be key to the dollar

The divergence between USD and US inflation, may to be key to the dollar

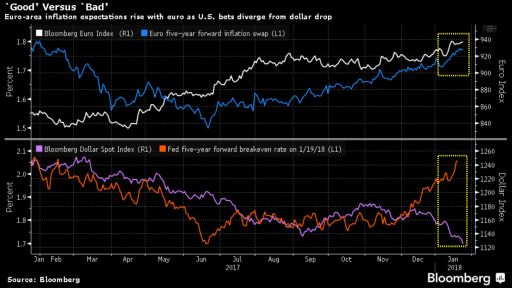

While inflation expectations on both sides of the Atlantic are rising sharply, the stronger euro and the weaker dollar suggest a different economic environment.

Today's PMI data from Germany and France imply good prospects for the euro area and the euro, confirming the idea that wage growth and increased demand for goods increase inflation. While inflation in the eurozone is rising, albeit with minimal footsteps, the euro notes this with full force, and the correlation between the Bloomberg Euro Index and five-year inflation is almost complete. Meanwhile, rising US inflation and inflated inflation expectations are not positively accumulating in the dollar's price, and even on the contrary, dollar declines every day as inflation rises.

What does this mean and what can we expect from the USD?

Looking back in time, inflation is key to the cost of a currency. Such deviations between USD and US inflation lead to a reversal in the price of the currency rather than in the value of inflation. In other words, if we take into account inflation, the USD remains underestimated, and we can very soon expect a reversal of one-year dollar downward trend.

Source: Bloomberg Pro Terminal

Jr Trader Petar Milanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.