- Home

- >

- FX Daily Forecasts

- >

- The dollar weakens against the euro and the yen, because of doubts about the next steps of the Fed

The dollar weakens against the euro and the yen, because of doubts about the next steps of the Fed

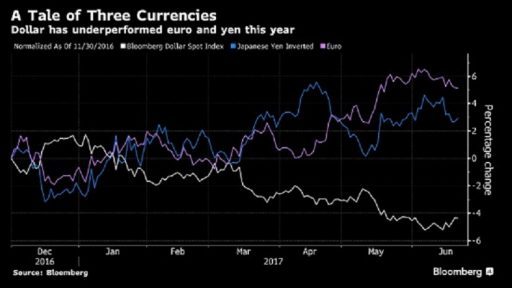

The euro and yen are set to keep on surprising this year on prospects the Federal Reserve will slow monetary tightening while central banks in Europe and Japan move toward reducing stimulus, Asia-based foreign-exchange strategists say.

Traders are betting the Fed will raise interest rates just once more this year after two hikes in the first half. Meanwhile its decision to set out some details on reducing its balance sheet may add to speculation the European Central Bank and the Bank of Japan will consider reducing asset purchases. The ECB this month ruled out further rate cuts and the BOJ is said to be thinking how to communicate an eventual policy change, even as Governor Haruhiko Kuroda reiterates he has no intention of ending stimulus soon.

The dollar has fallen against all its Group-of-10 peers this year, with the Bloomberg Dollar Spot Index sliding 5.3 percent. The lack of progress on U.S. fiscal stimulus and tax reform, a decline in Treasury yields and improving economic growth in Europe and Japan have weighed on the currency. The euro is the strongest performer versus the greenback, rising 6.2 percent, while the yen has gained 5.1 percent.

The ECB is likely to announce next year’s asset-purchase plans in September and reduce its monthly target, said Shuji Shirota, head of the macroeconomic strategy group at HSBC Securities Japan Ltd. in Tokyo.

Source: Bloomberg Pro Terminal

Jr Trader Ivan Ivanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.