- Home

- >

- Market Rumours

- >

- The ECB could signal future rate cut at its meeting tomorrow

The ECB could signal future rate cut at its meeting tomorrow

European Central Bank (ECB) President Mario Draghi didn’t leave any doubt about his institution’s conviction to do “whatever it takes” to counter a fall in inflation expectations when he spoke at the banks annual gathering recently in Sintra, Portugal.

All instruments are on the table and can be deployed. That was the message. The question now is: Will anything happen as early as this week?

Expectations are divided as to whether the ECB wants to pre-empt a policy move by the U.S. Federal Reserve that pushes down the dollar and strengthens the euro as this would hurt euro zone exporters and weigh on inflation further.

Traditional ECB watchers though expect a change in the central bank’s forward guidance at this month’s meeting on Thursday and then potential action on interest rates at its meeting in September.

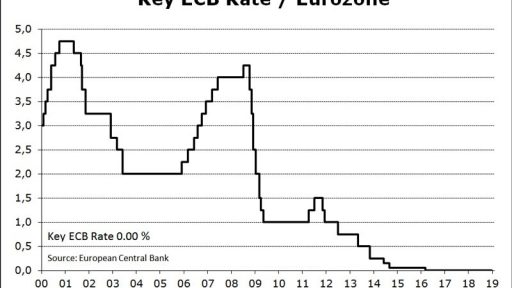

“In response to the weak growth and still subdued inflation, the ECB will likely adjust its guidance in July and vow to keep rates at ‘present or lower’ rather than just at ‘present’ levels,” said Florian Hense, an economist with Berenberg, in a research note earlier this month.

“In September the ECB could cut its deposit rate from -0.4% to -0.5% and to relaunch net asset purchases of around 40 billion euros for 12 months starting in (the fourth quarter of 2019),” he added.

Inflation expectations continue to be stubbornly low and the trade war risk is a drag on economic activity and sentiment especially for export-oriented economies.

Meanwhile, Carsten Brzeski, a chief economist at ING Germany, said in a recent note that it was worrying that there were now signs that the solid domestic part of the euro zone economy was also faltering.

“In particular, German data is worrisome with an increase in short-term working schemes, fading momentum in the labor market and falling retail sales,” he said.

Philip Lane, the ECB’s new chief economist, told an audience on July 2 in Helsinki that “my assessment is that the evidence shows that our package of monetary policy measures has been an effective response to the environment the ECB has faced in recent years.”

“Furthermore the effectiveness of the policy toolkit means that we can add further monetary accommodation if it is required to deliver our objective.”

Source: CNBC

Trader Georgi Bozhidarov

Trader Georgi Bozhidarov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.