- Home

- >

- Fundamental Analysis

- >

- The end of QE means more currency crises

The end of QE means more currency crises

The withdrawal of dollar liquidity, which the Fed began in the beginning of this year, has resulted in a soaring value of the dollar and slumping emerging market currencies over the last four months. This was a period in which we saw two currency crises - in Turkey and in Argentina. Historically, the Fed has not given much significance to foreign market developments if they don't seriously impact American markets; their priorities are inflation, employment and growth.

The debt of developing economies jumps from 143% of GDP in 2008 to 211% of GDP in 2018. Of this accumulated debt, debt denominated in dollars jumps from $2,8 trillion in 2008 to $6,4 trillion in 2018. According to Bloomberg Economics the countries that are most exposed to financial crises if investors sharply shift their sentiment towards risk aversion are Turkey, Argentina, Colombia, South Africa and Mexico. The large amounts of debt, which these countries have accumulated and must repay in very expensive dollars will exert a strong downwards pressure on their currencies against the dollar.

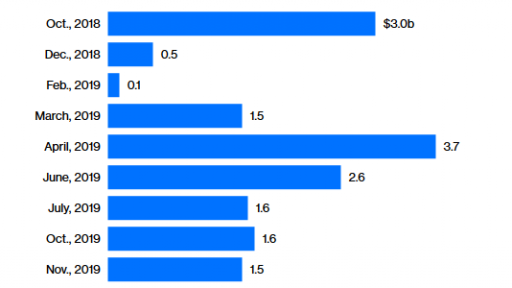

The chart to the left shows the months and the amount of debt, which Turkey must repay in dollars. Large amounts are due in October of 2018 and the second half of 2019. These will be the critical periods for the behavior of USD/TRY.

Image: Bloomberg Finance L.P.

Trader Velizar Mitov

Trader Velizar Mitov If you think, we can improve that section,

please comment. Your oppinion is imortant for us.