- Home

- >

- Daily Accents

- >

- The eurozone with a record economy growth, given the declining threats

The eurozone with a record economy growth, given the declining threats

The European Union said the eurozone is about to declare its highest growth rate over the past decade, as the political uncertainty that threatened to shadow the bloc this year has largely failed to influence.

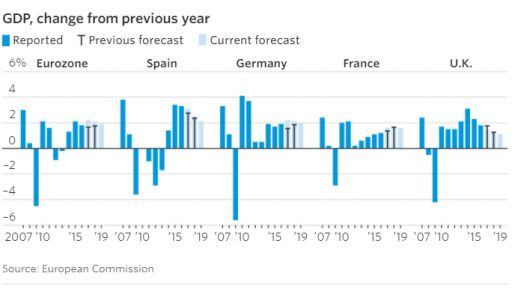

Led by the weak impact of the political turmoil that economists have feared, EU economist predictions indicate that gross domestic product in the 19 eurozone countries will grow by 2.2% in 2017, exceeding expectations of 1.7%.

Against the backdrop of solid consumer spending and global economic recovery, the GDP of the 28 EU member states is expected to grow 2.3% this year against a 1.9% forecast.

Improving the economic outlook reflects the wider global economic development that fueled the investment of EU companies. From a political point of view, centrists and pro-European governments held power in Germany, France and the Netherlands as a result of a busy cycle of elections this year, and the European Central Bank chose to keep its ambitious monetary policy unchanged.

Regardless of the optimistic forecasts, the EU said it still faces high inflationary pressures, compounded by the risks stemming from the United Kingdom's exit from Donald Trump's blockade and protectionist policy.

The threats were evident in the bloc's estimates for 2018 and 2019 when economic growth is expected to slow down. The euro area economy is expected to grow by 2.1% in 2018. and 1.9% in 2019 when Britain will leave the EU.

Looking at the UK, the country's growth is set to drop to 1.1% in 2019, when almost all the derails of leaving the EU will be reflected by the economy.

The UK economy, largely locally oriented, was hit by an acceleration in inflation following the vote last year by Brexith, limiting consumer spending. Expectations for growth in private consumption will be modest and uncertainty will continue to affect business investment decisions.

Unlike the United Kingdom, Spain is expected to avoid economic damage stemming from cataclysms in Catalonia. The EU has raised its forecast for Spain's GDP growth to 2.8% from 2.5%

For inflation in the euro area, it is expected to remain at 1.5% in 2017 and in 2018 to decline to 1.4%.

Source: Wall Street Journal

Jr Trader Petar Milanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.