- Home

- >

- Fundamental Analysis

- >

- The facts are saying – China not far from an economic crisis

The facts are saying - China not far from an economic crisis

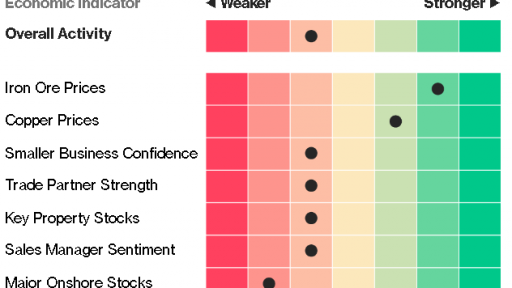

China's economic growth continued to slow down in October, a period when the trade conflict with the United States deepened, and politicians increased their support for business. At first glance, normal economic behavior, but in these circumstances, it is good to look deeply to find out exactly where the Chinese economy is and to break down the markets, like the crash in 2015.

What is happening with the Chinese economy in the fourth quarter of this year will be closely monitored, focusing on whether the government can keep the pace of growth stable without debt resumption.

"Early indicators show that economic conditions continue to weaken both on the domestic and external front," said Chief Asia Bloomberg economist Chang Shu. "Economic moods are very bad, especially among small private companies. We expect the political support of the economy to continue to expand with all aspects of growth - exports, consumption and investment."

The government has introduced a number of mood stabilization measures this month, including steps to boost liquidity in the financial system, new tax cuts for households, and targeted measures to help exporters. ... it seems that the cold-blooded behavior on the part of the Chinese authorities is over.

To improve the aforementioned indicators, a long period of economic growth is lacking on the horizon, and high prices of steel and copper (a large part of which imports) remain high in China's economic condition. Given this, GDP expectations will fall dramatically in the coming months, and the start of 2019 may be less favorable to bulls.

Source: Bloomberg Finance L.P.

Charts: Used with permission of Bloomberg Finance L.P.

Trader Petar Milanov

Trader Petar Milanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.