- Home

- >

- Stocks Daily Forecasts

- >

- The FED slowed its monetary policy, indexes rose at the end of the session

The FED slowed its monetary policy, indexes rose at the end of the session

Shares managed to break away from their lowest points at the end of the session today after news came out that the US Federal Reserve may slow the pace of tightening its monetary policy.

Earlier today, it was reported that the central bank is considering whether to give a signal to the markets that they will rather take a wait-and-see position on interest rates. This is expected to happen at their next meeting. Representatives of the Fed said they do not have a clear idea of their next move after December.

"This week we saw exceptional market sensitivity for every line of news that comes out and more than just the usual." - says Delores Rubin, senior trader at Deutsche Bank Wealth Management.

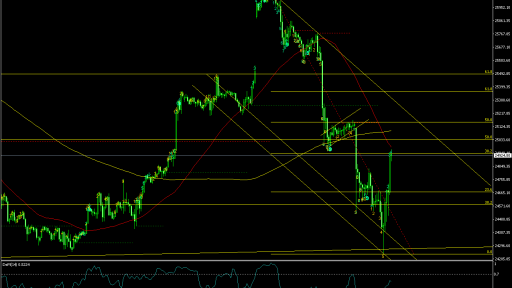

The Dow Jones Industrial Average finished 79.40 points below 24.947 after the price dropped by 800 points for the day, while the S & P500 ended the session by 0.15% down to 2.655 and NASDAQ Composite wiped out the losses and closed 0.4% higher to 7.188. Amazon, Netflix, and Alphabet rose by more than 1% in total, leading the recovery.

The stock market suffered a sharp decline at the beginning of the session, following fears that trade relations between China and the United States will continue to worsen, as well as worries about economic slowdown. These fears were bolstered after Wednesday's news that Huawei, Meng, Wanzhou's CFO was arrested by the Canadian authorities in Vancouver. She is expected to be extradited from the United States. With this, hopes for a long-lasting and secure trade deal between Beijing and Washington disappear. The news has prompted a strong volatility in the futures market. Even CME Group had to freeze trade for a short while.

Source: CNBC

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.