- Home

- >

- Daily Accents

- >

- The first estimates for US GDP Q3 are available

The first estimates for US GDP Q3 are available

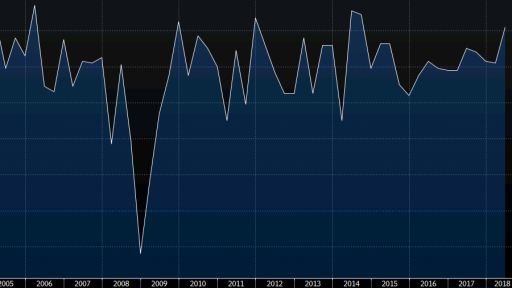

We still have a very early first forecast of what number we will get for US GDP in Q3 of this year. Of course, the data will go through several revisions, but the markets like to assimilate more initial data quickly as if they were the final results.

Uncertainty over growth is reflected in the different forecasts. Economists predict that the US will grow by 2.4% (Wrighton ICAP) to 2.6% (JPMorgan) and even to 4.1% (Pantheon & RBC), but the consensus is 3.3%, which is a good result for the third quarter, whereas in the second there was a growth of 4.2%.

According to Bloomberg-Daiwa's second-largest US economy analyst, he sees growth of 3.5%. According to them, they see some growth in this quarter, although expansion is largely due to investment. Daiwa predict that the final result will be 2.2% without investments, and the value will also be reduced by a temporary decline in exports that was in response to actual or potential tariffs.

Barclays is also worried that reduced exports will be a key factor in the final GDP value.

They forecast an increase of 3.5%. Their expectations are supported by increased domestic consumption and government spending, which has affected the current fiscal policy. Taking these factors into account, their forecast is to increase household consumption nationwide. They also expect a significant positive contribution from investors' activity, which has been momentarily affected by the slowdown in exports.

According to TD, the available goods will also be key to the development of inflation and GDP.

They expect growth of 3.7% in Q3 by 2018 for GDP, driven by strong consumption and strong investor activity. For them, however, reduced investment in business and the impact on trade in the trade war may have a negative impact on the final value of GDP.

We also see a large discrepancy between the forecasts of the two largest institutions that track the GDP of the Federal Reserve. The New York Fed predicts a growth of only 2.13%, while the Atlanta Fed points to a potential growth of 3.6%, indicating a serious contradiction between the two largest branches of the Federal Reserve.

Charts: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.