- Home

- >

- Fundamental Analysis

- >

- The five indicators that will tell us whether a recession is set

The five indicators that will tell us whether a recession is set

The flow of economic data continues to keep investors under pressure. Meanwhile, tensions around the trade war are on the rise, and we still see signs of a slowdown in the global economy. It's not surprising that investors and traders keep asking themselves: Is there a recession for the US economy?

Although economic expansion is on track to beat any record, the risk of recession has risen to a six-year high. The majority of managers, investors and analysts expect a recession by the end of 2020.

And while there is no single, universal indicator to predict recessions, the combination of several indicators can give us some insight into what awaits us in the path of economic development.

The yield curve

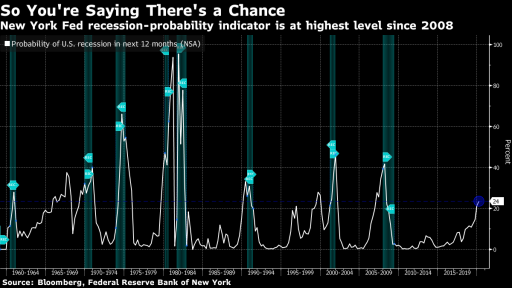

This may be the most closely monitored market tool for potential market reversals. The latest indication of the chances of recession reported a 23.6% chance of recession over the next 12 months, the highest level since 2008. References below 50 are not necessarily safe. The index has not gone above this level since 1980, although we have experienced several recessions since then.

Consumer and business sentiment

Investor billionaire Jeffrey Gundalch said last month that the widening gap between consumer mood versus the current situation and expectations is currently the big signal of a recession. Meanwhile, measuring business mood has lost its leading position since Trump was elected president. It is clear that this confidence and confidence is diminishing during negative events, but their credibility is criticized by how mood predestines that a recession is coming.

Conducting surveys in the manufacturing sector

The same applies to research in the manufacturing sector. This indicator tends to keep fluctuating every next month, but for the first of May 2016, all production indicators declined together. ISM - the national production index fell to two-year low, seeing a partial recovery in January. An additional and prolonged decline in production figures will indicate that the sector declines. However, this does not necessarily mean that the economy is experiencing difficulties.

Global economic growth

The Federal Reserve was forced to pause its monetary policy precisely because of the slowdown in global economic growth. Goldman Sachs has devised an attached way of determining how far this slowdown will affect the US economy as well. The bank says that for every 1% decline in global growth, the US economy shrank by half. Economists are currently predicting a 14 percent chance of recession in the US next year. A 3% decline in global growth will raise the chances of recession to 46%.

Real economic data

After all, evidence that a recession is about to emerge will be reflected in key indicators of the US economy, including the labor market, income and hourly pay, sales in business, and, of course, gross domestic product. These are some of the indicators that are being considered by the National Bureau of Economic Research - the institution - an arbiter for the beginning and end of recessions in the United States. For the time being, the values above do not yet glow in red, but when it starts, it will be too late for any additional forecasts.

Source: Bloomberg Finance L.P.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.