- Home

- >

- Fundamental Analysis

- >

- The four forces that will move the markets in 2019

The four forces that will move the markets in 2019

In recent months markets have been shaken, which has irritated investors and traders. However, given so many fundamental and macroeconomic factors in a negative aspect, which appear constantly, it becomes rather difficult to understand the price changes. And if a trader does not have the necessary skills to filter the right information, it will be hard for him to make money.

That's why Goldman Sachs is helping the investor to help them get oriented properly and start focusing on really significant assets. The Bank has distinguished four major driving forces in the markets that we could use to make the right decisions for the future.

But there is a small problem.

"What is most important for the performance of the shares are the marginal changes in each of the variables that are related to the expectations of the investors." - says David Kostin, chief strategist at Goldman Sachs in the US stock market.

The FED policy and the interest rate

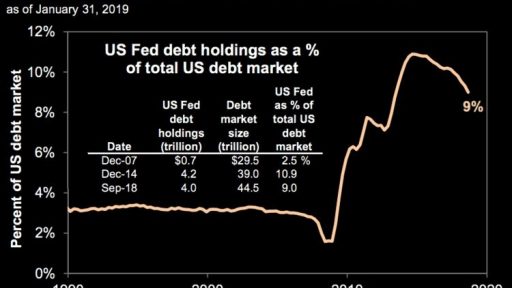

Questions arise whether QE (quantitative equalization) and QT (quantitative tightening) will have a symmetrical effect on the assessment of risk assets. The reason for this is that, as QE has increased ratings, QT will reduce them. We believe that this statement is overestimated. "

Soon, the Federal Reserve is shrinking its bond portfolio at a rate of $ 50 billion a month. At this rate, the Federals will reduce their holdings with $ 600 billion over the next 12 months.

China and economic growth

Although economic data for China in December were slightly above expected, the downward trend in economic activity remains a cause for concern. The flows of regional trade are decreasing. The China Current Activity Indicator (CAI) index has fallen below 6% to its lowest level for the first time since 2009. Economists from Goldman expect additional stimulus, mainly fiscal.

Trade policy

The bank, based on talks with its clients, understands that most investors expect the US and China to reach an agreement to avoid the implementation of the new $ 200 billion scheduled tariffs on China's imports.

Although mutual efforts to reduce trade deficits have led to increased imports of soybeans from China, the issue of intellectual property remains a major challenge. Shares will reflect a decline if there is no agreement to the deadline or a decision to delay the upcoming tariffs.

Earnings season

The EPS value of the S & P500 for 2019 was cut by 2% last month, and in the last three we had a cut of up to 4%. Investors rewarded companies reporting higher than EPS estimates. Expectations have surpassed the broad performance index by 247 basis points in several consecutive trading sessions.

Source: Business Insider

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.