- Home

- >

- Fundamental Analysis

- >

- The global economy is vulnerable to missteps by central banks

The global economy is vulnerable to missteps by central banks

According to the CEO of Northern Trust, after the 2008 crisis, the global economy is in a "delicate balance" that can easily be broken by a mistake by one of the major central banks.

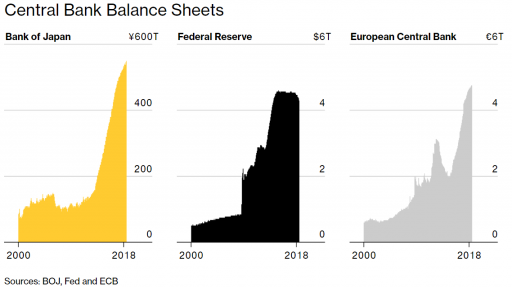

On the chart on the left are depicted the portfolios of the Federal Reserve, BoJ and ECB. The QE programs (quantitative relief) post-crisis inflate banks' portfolios. During the crisis, QE is the reason why the global financial system does not collapse. Now, however, quantitative easing can be the cause of the next crisis. The Federal Reserve is already stopping the purchase of securities under its QE, and the ECB is likely to end the stimulus by the end of this year.

It is scary that tightening the Federal Reserve this year has led to currency crises in Argentina, Turkey and South Africa, and the real Fed's interest rate is still around 0%. And the Federal Reserve portfolio has almost dropped from the peak of about $ 4.5 trillion. In other words, we still can not talk about a serious tightening in financial terms. This will change in 2019 and 2020, when both the ECB and the Federal Reserve (and probably BoE) are expected to start raising interest rates and taking away liquidity from the financial system.

Source: CNBC

Original post: The global economy is in a 'delicate balance' that risks central bank missteps, CEO says

Chart: Used with permission of Bloomberg Finance L.P.

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.