- Home

- >

- Daily Accents

- >

- The gold and Yen rose, amid North Korean tension – market wrap

The gold and Yen rose, amid North Korean tension - market wrap

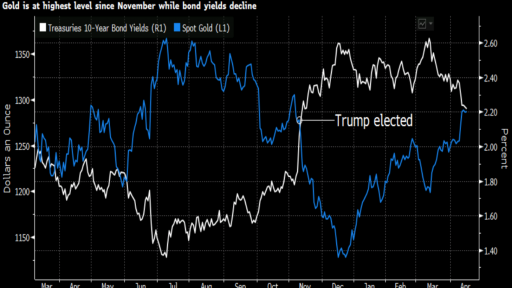

Treasuries extended their rally as soft inflation data from the U.S. fed into markets after the long weekend, and the dollar fell. Lingering geopolitical concerns in Asia offset upbeat economic data from China, ensuring haven assets gained.

Trading was light, with many key markets still shut for Easter. The yield on 10-year Treasuries fell two basis points to the lowest since Nov. 11, while Bloomberg’s Dollar Spot Index slipped to the weakest in three weeks. Gold and the yen both climbed. Turkey’s lira jumped as much as 2.4 percent after voters handed President Recep Tayyip Erdogan greater powers. The currency pared gains as investors digested the referendum result.

Macro news and events have been piling up over the long weekend, from inflation data casting doubt on the pace of Fed rate hikes and the U.S. decision not to label any countries currency manipulators to North Korea’s failed ballistic missile launch and Turkey’s referendum. Investors will be bracing for more to come, as the earnings season ramps up and European populism is put to the test in the first round of France’s presidential election.

For global markets generally and European markets in particular, the first round of the French presidential election on Sunday is probably the biggest planned event of the week.

Here’s what investors are watching this week:

* Australia, New Zealand, Hong Kong and most major European markets won’t reopen until Tuesday.

* The annual spring meetings of the World Bank Group and

the International Monetary Fund take place in Washington.

* Companies reporting this week include Bank of America Corp., Goldman Sachs Group Inc., International Business Machines Corp., Netflix Inc., Heineken NV and Unilever.

Here are the main moves in markets:

Currencies

- The Bloomberg Dollar Spot Index fell 0.3 percent at 7:51 a.m.

in New York to the lowest in three weeks.

- The euro rose 0.2 percent to $1.0641.

- The British pound strengthened 0.2 percent to $1.2547, the strongest in more than two weeks.

- The Turkish lira rose 1.5 percent to 3.6561 per dollar.

Stocks

- Futures on the S&P 500 index were down 0.1 percent. The gauge lost 1.1 percent for the holiday-shortened week.

- The MSCI Emerging Market Index slid 0.2 percent.

Bonds

- The yield on 10-year Treasuries fell two basis points to 2.21 percent, the lowest in about five months.

Commodities

- Gold rose 0.2 percent to $1,288.28 an ounce, the strongest in more than five months.

- West Texas Intermediate crude fell 0.7 percent to $52.80 a barrel, the lowest in more than a week. The U.S. continued to ramp up drilling, stoking concerns the nation’s surge in output this year will counter OPEC-led efforts to cut a global supply surplus.

- Iron ore fell 2 percent to 501 yuan per metric ton, the lowest in more than 14 weeks.

Asia

- The yen extended gains at a five-month high amid persistent concern over the situation with North Korea.

- Chinese shares tumbled even as the country’s GDP strengthened, while Japanese stocks rose amid speculation recent selling was overdone.

Source: Bloomberg

Jr Trader Petar Milanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.