- Home

- >

- Daily Accents

- >

- The Great Corn Clash Is Coming as U.S., Brazil Farmers Face Off – Possible fall of the price

The Great Corn Clash Is Coming as U.S., Brazil Farmers Face Off - Possible fall of the price

The world’s biggest corn exporters are preparing for a showdown.

Brazilian farmers are in the midst of collecting their biggest corn harvest ever and American supplies are also plentiful -- setting the stage for a stiff battle to win world buyers in the second half of the year. It’s a turnaround from just a year ago when U.S. exporters were seeing sales boom as a drought plagued Brazil’s fields. This year, the South American growers enjoyed much better weather and crop supplies have gotten so big that farmers are already short on storage after collecting a massive soybean harvest just a few months earlier. That’s giving exporters incentive to push corn shipments out quickly and could mean a squeeze for hedge funds that are betting on a price rally.

"Buyers rule in the global corn market this season," Pedro Dejneka, a partner at Chicago-based MD Commodities, said in telephone interview. "Competition between the two major exporters will be tough."

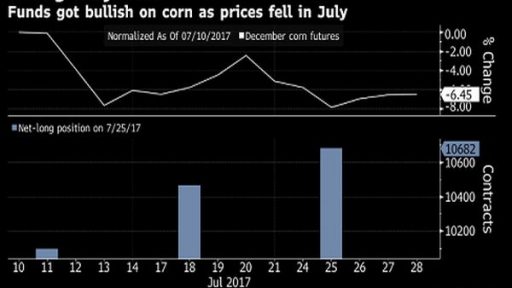

December corn futures on the Chicago Board of Trade have dropped 1 percent in July to $3.88 a bushel, heading for the first monthly loss since April. While the ample supplies and shifting U.S. weather patterns dragged prices lower, the declines were a surprise to hedge funds, who were positioned for gains. Money managers increased their net-long position, or the difference between bets on a price increase and wagers on a decline, by 2 percent to 106,815 futures and options contracts in the week ended July 25, according to U.S. Commodity Futures Trading Commission data. The next day, futures fell to the lowest in almost a month. Brazil’s corn production in the 2016-17 season is forecast to surge 45 percent from a year ago to a record 97 million metric tons, according to the U.S. Department of Agriculture. The agency estimates that the 2016 U.S. harvest reached an all- time high and that the crop gathered this fall will be the second-bigger ever. The USDA will make its first survey-based estimates of U.S. production in August.

Competition has ramped up for farmers in the U.S., the world’s biggest grower and exporter. Brazil, which barely shipped any corn just two decades ago, has since emerged as a significant competitor. Sales are also on the rise from Argentina, which reaped a record harvest this season.

Brazil’s shipments normally climb at this time of year, the heart of the country’s winter harvest, and its expected exports are the highest ever, according to vessel line-up figures through 2013. U.S. growers will collect their next crop between September and November.

Meanwhile, U.S. corn shippers are seeing slow bookings for the coming marketing year, which starts in September. The 4 million tons of new-crop outstanding sales as of July 20 were 44 percent below last year and the lowest for the date since 2010, USDA data show. "U.S. exports probably will continue to flag lower, while South America’s continue push higher,” Don Roose, president of U.S. Commodities in West Des Moines, Iowa, said in a telephone interview. "It’s going to be a real fight."

Still, even as Brazil’s shipments surge, the U.S. is expected to remain the world’s top supplier. The South American country’s success in stealing market share partly depends on moves for the Brazilian real and how many farmers are willing to sell crops at low local prices, said Paulo Molinari, an analyst at Safras & Mercado consulting firm. The size of the 2017 U.S. corn harvest also remains a key factor to determine the room Brazil can occupy in global trade.

Source: Bloomberg Pro Terminal

Trader - S. Fuchedzhiev

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.