- Home

- >

- FX Daily Forecasts

- >

- The “Hot” financial instruments from the night session

The "Hot" financial instruments from the night session

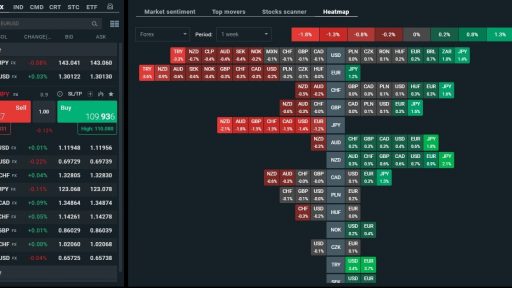

The best deal for this night, of course, was the so-called safe haven instruments (without surprises), amid the backdrop of increased tensions around the US-China trade deal. At the same time, Kiwi (NZD) remained under strain after the Reserve Bank of New Zealand (RBNZ) decided to lower the country's benchmark interest rate during the previous Asian session.

The yen, as a mean of protecting against the volatility and uncertainty of the fundament, rose 0.2% against the dollar, trading currently at 109.92, as worries about the escalating trade war were the cause of a new day of stock market losses.

The Chinese delegation, headed by Vice Premier Liu He, will meet with representatives of the White House later today. US President Donald Trump said on Sunday he would raise Chinese commodities worth $ 200 billion to 25 percent from 10 percent if no mutual agreement is reached by the end of the week.

Washington accused Beijing earlier today of spoiling the deal. Midnight, Trump commented on Twitter:

"By the way, you see the tariffs we're doing? Because they broke the deal. They broke the deal," Trump said. "So they're flying in, the vice premier tomorrow is flying in — good man — but they broke the deal. They can't do that, so they'll be paying."

The currency pair USD / CNY gained 0.4% to 6.8071. Data showed this morning that the CPI in April jumped 2.5 percent year on year, within the expectations, but slightly higher than 2.3 percent on an annual basis in March.

At the same time, NZD remains under pressure after RBNZ cut interest rates from 1.75% to 1.50% on Wednesday. Kiwi fell to a 6-month low immediately after the news of the central bank.

Trader Aleksandar Kumanov

Trader Aleksandar Kumanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.