- Home

- >

- Daily Accents

- >

- The Irish border stay a major scourge of the pound

The Irish border stay a major scourge of the pound

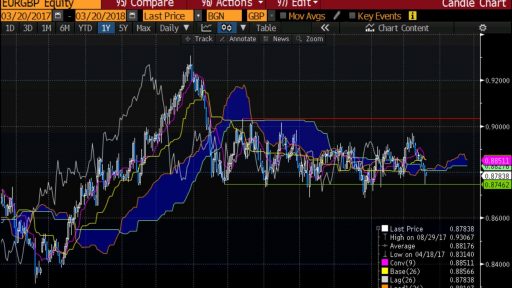

Every time there's an apparently positive headline on Brexit, it seems you only have to wait a little while for the pushback or proviso. Even with yesterday's news on a transition plan, the prickly issue of the Irish border remains, and until this significant challenge is surmounted, it's hard to see EUR/GBP breaking out of its continued bout of range-trading.

Yesterday's price action in the pair followed the template from Dec. 8 (when the first round of Brexit talks was completed). The pound rallied sharply early in the day on the good news and then unwound a big chunk of that. EUR/GBP closed that day at 0.8792, within a few pips of yesterday's close. Back then, as today, the Irish border remained the major sticking point. Until it is solved, don't expect much EUR/GBP downside.

Why downsizing, not growth? A quick look at the couple's chart shows that after the Brexit decision, the EUR quickly takes things in its own hands, after which the price goes into broad consolidation. From September 2017. the consolidation in question narrows considerably in the area between 0.8730 and 0.8970. Initially, the investors reflected the worst case scenario for Brexit, which would have a detrimental effect on the British economy, and for that reason the GBP recorded a significant decline, and despite consolidation, a large number of investors believe the British currency is underestimated. For this reason, any news of a deal has a positive impact on the British currency.

Source: Bloomberg Pro Terminal

Jr Trader Petar Milanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.