- Home

- >

- Stocks Daily Forecasts

- >

- The Italian crisis provides a good opportunity to buy bank shares, but it’s still too early

The Italian crisis provides a good opportunity to buy bank shares, but it's still too early

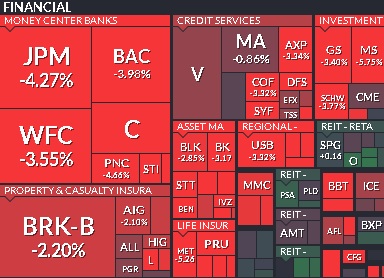

It's too risky for investors to step back into major U.S. bank stocks, even after Tuesday's ripping selloff shaved more than 4 percent off of JPMorgan Chase and nearly 3.5 percent off of Goldman Sachs, says bank analyst Richard Bove.

The U.S. financial sector led the market sharply lower Tuesday amid fears that Italy will try to exit the euro zone and leave the single currency. European banks stocks were crushed, and yields spiked on Italian bank debt. The S&P financial sector was down 3.4 percent.

"It would be irresponsible," to jump in now, said Bove, an analyst with Hilton Capital Management. "You have no idea what's going to happen near-term and you understand that it's the psychology that's got to calm down first."

Bove said there would be an immediate crisis affecting Italy's banks and economy should the country try to exit the euro. Over the weekend, Italian President Sergio Mattarella blocked the formation of a government that would have been decidedly against the euro.

The anti-establishment Five Star Movement, Italy's biggest party, and the far-right League party picked euro-critic Paolo Savona as their economy minister. The two parties, both critical of Europe's single currency, had won more than half the votes in March's parliamentary elections. Mattarella vetoed the choice and instead asked Carlo Cottarelli, a former IMF official, to form a temporary government, but both parties object to him and a new vote is now expected in late July.

"The first thing that happens is their banks may lose access to credit in the world market, but the banks will lose the ability to function because they have such a large proportion of Italian debt on their balance sheet. The country goes into recession or depression," said Bove. "You have to ask yourself whether the Italian citizens say, 'We think it's worth taking this depression or we're going to stick to our guns.'"

While U.S. institutions could withstand the blow of an Italian exit, Bove said they would still feel the effects.

Bove said he would not be a seller of the big banks, but now is not yet time to find bargains.

"There's too much risk to buy into the big banks at this moment unless you're absolutely convinced Italy cannot get out of the European Union. I am convinced of that and because I'm convinced of that, I think at some point you have to step up and buy these big banks because they're being oversold, but the market is not convinced of it," he said.

Bank of America shares lost more than 4 percent, and Morgan Stanley was down nearly 6 percent. Citigroup was off 4 percent. The XLF, Financial Select Sector SPDR ETF, fell more than 3 percent.

If separated, Italy would no longer be able to seek assistance from the European Central Bank. Italy would have no where to turn, and its currency would become useless because it would be based on its own economic growth.

Bove said the $50 billion in U.S. tariffs on Chinese goods announced Tuesday could also have been a factor affecting the market.

"Logic would argue we're not going to see a total breakdown in world trade, that the European Union is not going to come apart because it's too costly for everyone in Europe if that were to happen," he said.

"In my personal portfolio, I'm looking for a point to get back in," he said. "It's too early for me to get back in. There's too much risk in the situation."

Source: CNBC

Trader Georgi Bozhidarov

Trader Georgi Bozhidarov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.