- Home

- >

- Daily Accents

- >

- The Italy elections are still unclear, what can expect from the EUR?

The Italy elections are still unclear, what can expect from the EUR?

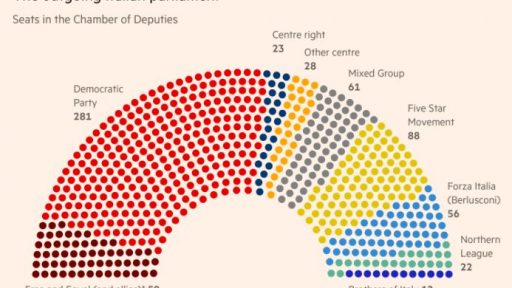

The Italians headed for the polls, as well as at this point, and maybe by the end of the election day there would be no leader among the parties to form a coalition without a coalition. 28% think the election will not lead to the election of a single government, and 33% think it is possible a coalition between former Prime Minister Matteo Renzi's Democratic Party and the conservative party led by Silvio Berlusconi. 26% say the vote will not be a winner and the elections will have to be repeated after 6 months.

What about EUR?

Because of the parliamentary elections in Italy today, investors are most afraid of political change. They worry that the populist forces that France and the Netherlands avoided last year will come to power. If this is true, even in the small hours of March 5, the EUR will probably head to a new bottom. But why? Let's get the facts about the Italian economy out.

GDP registered its highest growth since 2010. But it is only 1.4% below Britain's 1,7% hit by Brexit and well below the 2.5% average in the eurozone.

Unemployment declined from 11.8% at the end of 2016 to 10.8% in December 2017. It is still well above the eurozone average of 8.7%, not to mention the level of 3.6% in Germany.

Italian government debt has increased from the already high 100% of GDP at the end of 2007 to over 130% - a burden for the economy, which is heavier in Greece only in Greece.

It is these figures that disturb the financiers in Italian equities as well as in EUR. If the anti-European parties come to power, the risk for Italy's economy will get a whole new dimension, and most likely, some of the existing foreign investment will retreat, and the new ones will collapse faster than expected.

Source: Bloomberg Pro Terminal

Jr Trader Petar Milanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.