- Home

- >

- Stocks Daily Forecasts

- >

- The machines didn’t took part in the sell – off this time

The machines didn't took part in the sell - off this time

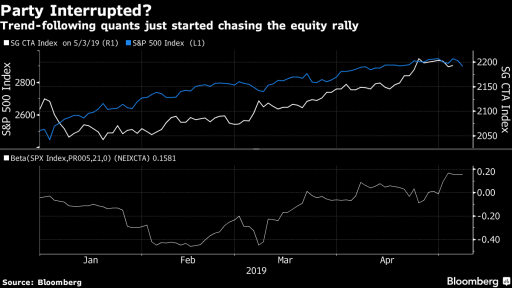

Algo traders this time stayed away from the market sell - off, despite Donald Trump's comments in Twitter and the increased market volatility.

Most trending, short-term investors, including commodity traders and hedge funds, are more in a pending regime than to pursue the market. This shares Masanari Takada, a quantum strategist for Nomura Holdings. The renewed trade strain, however, threatens to derail the 16% rally in the S & P500, which began earlier this year. According to Nomura, there is a risk that these investors will begin to close their long positions.

The steady bullish rally has proved to be very gratifying for quant traders who only seek reliable momentum to take advantage of. Trend - the following traders recorded their best month (April) for the past 15 months. Hedge Funds, which successfully leveraged assets based on volatility, also had an impressive first quarter thanks to growth in both stock and bond markets.

All this is threatened by Donald Trump, who threatens to raise tariffs on Chinese goods. The VIX index recorded its biggest two-day jump since December, and the stock recorded its worst day for more than a month.

Due to the fact that hedge funds and commodity traders use leverage to drive market momentum and volatility, both sides are often guilty of increasing market movements at times, especially in a sell-out situation. But at least for now, bonds are rising against the backdrop of stock depreciation, which spills losses to these investors.

However, the careful positioning of other investors this year can mitigate the sell-off pressure.

"Global macro (hedge funds), long-term and short-term equity-traded funds, for the most part, stayed aside, not pursuing the market since the start of the rally, so they managed to avoid selling," Takada said. "Global macro hedge funds in particular have already recovered the profits from their short positions in US stocks, and this short-term coverage creates some support for the market"

Source: Bloomberg Finance L.P.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.