- Home

- >

- Stocks Daily Forecasts

- >

- The market correction is over – or is it

The market correction is over - or is it

Weakness in S&P futures shouldn't be too surprising. After all, there's no discernible trend yet for U.S. stocks after the earthquake of the last two weeks, and so they're bouncing from one extreme to another.

Take, for example, the reading of more than 80% of S&P 500 stocks advancing yesterday and Friday. You have to go back to Sept. 21 & 22 of 2016 to find the last time that happened, which is when the Fed sat on its hands. The broad gains come, of course, after nearly every stock in the index fell on Monday and Thursday last week.

Or peek at the Bollinger Bands. The S&P had a nearly unbroken five-month streak of hugging the upper boundary. Now it's doing somersaults on the lower band.

Instinet technical analyst Frank Cappelleri asks of the nascent rebound, "do we trust it?" Too early to say, but a step toward trust would include turning the trend from lower highs to higher highs. And yesterday's slippage at the close may cause some traders to have some doubts.

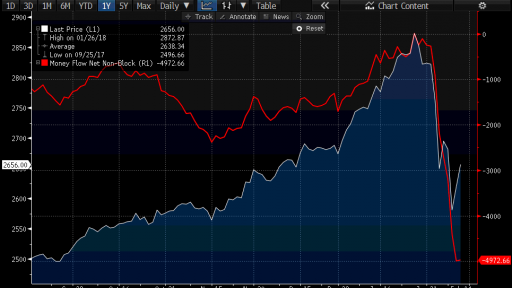

With a cash flow analysis compared to the S & P 500, it is noticed that although the index seems to have turned and the selloff is over, net cash flows remain at a record low. This suggests that the sentiment around the traders is still negative and will weigh on the stock.

Source: Bloomberg Pro Terminal

Jr Trader Alexander Kumanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.