- Home

- >

- Daily Accents

- >

- The market got what it expected, but did not get what it hoped for

The market got what it expected, but did not get what it hoped for

The Federal Reserve is well positioned to bring interest rates in the U.S. back to neutral levels, and it may need to raise rates two or three more times, former Fed Governor Robert Heller said.

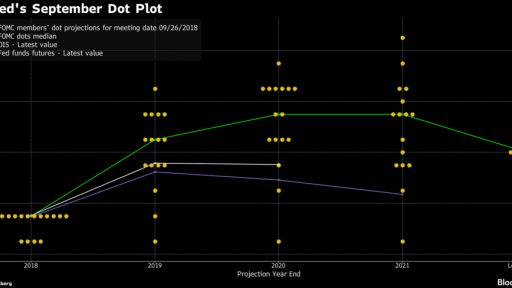

The Fed on Wednesday raised its benchmark interest rates by 25 basis points — its fourth hike in 2018 and the ninth since December 2015 when it started rolling back post-crisis stimulus. The central bank projected it would enact two interest rates increases in 2019, which was down from a previous forecast of three, but that wasn't enough to appease investors who had hoped the Fed would ease even further off its tightening path.

But for Heller, who said he favors "even tighter policy," the Fed did exactly what it had to.

"The Fed is really in a sweet spot right now: Growth is good, unemployment is very low at 3.7 percent and they're roughly at their target of 2 percent inflation. So, what could be better?" Heller told.

"They have to continue on their path of taking away the accommodation and get into a neutral stance and that's exactly what they did," he added.

Heller was a member of the Fed's Board of Governors from 1986 until 1989.

U.S. stocks sank after the Fed decision on Wednesday. Wall Street has had a wild ride in the last few months amid growing worries of a global economic slowdown — which U.S. President Donald Trump has blamed in part on the Fed hiking rates.

"I think the market got what it expected and that was a 25 basis points increase, but did not get what it hoped," John Petrides, managing director and portfolio manager at Point View Wealth Management, told CNBC's "Squawk Box" on Thursday.

Petrides said investors may have been disappointed because, just last month, Fed Chair Jerome Powell said he considered the central bank's benchmark interest rate to be near its neutral level — the point where monetary policy is neither speeding up nor slowing down the economy.

Many took that comment as a sign that the Fed could be near the end of its tightening cycle, but were let down when Powell's latest remarks on Wednesday indicated that the central bank still intends to raise rates, Petrides noted.

Source: CNBC

Chart: Used with permission of Bloomberg Finance L.P.

Trader Georgi Bozhidarov

Trader Georgi Bozhidarov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.