- Home

- >

- Daily Accents

- >

- The market pulse. Where to look for profits?

The market pulse. Where to look for profits?

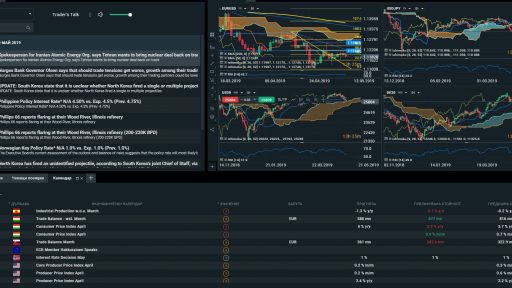

The US-China shootings on the trade agreement continue. In parallel, South Korea has announced that North Korea has launched an unidentified projectile. This, on the one hand, raises the situation and prompts traders to stay on the sell button. On the other hand, the EU's firm hand in terms of Iran and the nuclear agreement has at least achieved so far, and Tehran has announced that they want to continue to participate in this agreement.

Where to look for profits in this precarious situation?

First of all, we can expect oil recovery at least in the short term, but we need to be cautious about new threats from Trump, new sanctions or responses from Iran. The WTI levels are suitable for long positions with SL 61.30 positioning, with a break below this level might be leading to a further sharpening of the situation and a serious downturn.

The indices remain at good levels in a fairly sold out buy area, but we must be careful again. With a DAX Break below 12020, it can unlock serious sell orders and see a serious drop. The DJIA breakout below 28785 from today for now remains fake, as the current bar is 13 on DeM Sequential and one positive development of US China trade deal may lead to serious purchases but once again at a new intraday low we have to be prepared for probable sales.

The start of the European session was extremely negative, but now at 12:00 it is likely that bank traders will close positions, at least in part in anticipation of the sentiment from the US, with the opening of Wall Street now again to expect dynamics and look again for clues on the market diraction.

In the short term, we can expect an upward corrective movement in risk assets as a whole at least until the start of the US stock market.

The USDJPY foreign exchange market remains under serious surveillance, with a positive development of commercial tensions leading to serious purchases. USD remained strong compared to other currencies, with only JPY in negative territory due to the risk of market sentiment. Technically, it has 9k on the previous bar and raises stops after this serious downturn, which gives a good opportunity to look for long positions, but only after confirmation from the foundation.

EURUSD remains under pressure as yesterday the banking sector in Europe has remained under strain, suggesting that the ECB may need to add new incentives beyond TLTRO and that leads to negative sentiment towards the euro. Current levels do not seem appropriate for a new sell, but rather it is logical to keep the open positions if they are in the 1.1260 or higher range.

AUDUSD and AUDJPY continue to set new lower intraday yesterday, indicating serious tensions over a US-China deal, but a new short positioning seems to be illogical and disadvantageous given the current risk / reward opportunities.

Trader Nikolay Georgiev

Trader Nikolay Georgiev Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.