- Home

- >

- Daily Accents

- >

- The market seems to be digesting this in a very calm way

The market seems to be digesting this in a very calm way

Stocks kicked off the week with losses, oil prices rose and gold jumped to a six-year high as an escalation in geopolitical risk in the Middle East reverberated around the world.

The pullback reflects investor anxiety following the U.S. airstrike last week that killed a powerful Iranian general in Iraq and raised the prospect of more violence across the oil-rich region.

The sudden focus on risk of greater conflict in the Middle East halted a recent winning streak for U.S. stocks, which had been at record levels. Stocks around the world have been pushed higher by expectations that easing trade tensions between the U.S. and China will boost global growth.

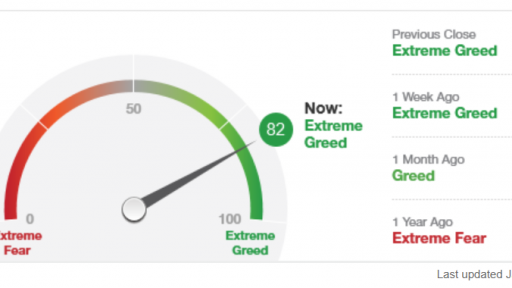

Still, the reaction in the markets wasn’t severe enough to suggest panic. The market seems to be digesting this in a very calm way, relative to how it’s reacted in the past when there’s been dramatic escalation of tensions in the Middle East.

On Sunday, the Iraqi parliament passed a nonbinding resolution to expel American troops. President Trump responded by threatening sanctions and demanding billions of dollars from Baghdad if the U.S. is forced to withdraw. Iraq is the second-largest oil producer among OPEC nations and a hit to its oil industry would reverberate widely.

Gold, which is seen as a haven asset, jumped to $1,566 an ounce on Monday, its highest level since April 2013, according to FactSet. Oil prices jumped, continuing a recent rally.

Trader Georgi Bozhidarov

Trader Georgi Bozhidarov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.