- Home

- >

- Daily Accents

- >

- The market situation so far

The market situation so far

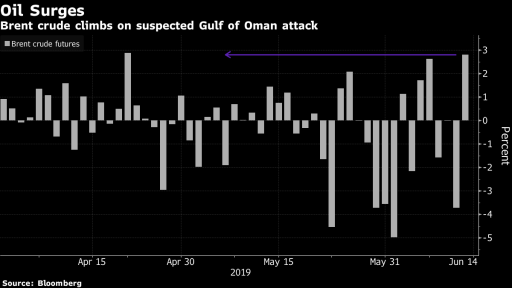

US stocks at the beginning of their session started rising along with European ones, as early as in the Asian session the markets reflected losses. Geopolitical tensions have increased as oil has suffered most. The oil price for today is almost 4% up the news that two oil tankers have been attacked in the Persian Gulf.

The S & P500 recorded a five-week peak after the data for the aid applications surprisingly showed growth. This reinforced the belief that the Federal Reserve would stick to the idea of reducing interest rates. European stocks started in red, but they quickly wiped out the losses and ended up in green. Investors, however, remain concerned about the trade war, the Fed and the government securities.

Today, however, oil was the big winner. WTI and BRENT are on track to record their best rise since January, just after the news of the two tankers that have been attacked. The news, however, remains veiled in mystery again who the perpetrator is and why.

Investors are trying to keep up the positive sentiment, despite the day-to-day counter-winds and political / geopolitical tensions around the world. Today's attack is a consequence of the attacks a month ago in the region, which only further exacerbates tension. In Hong Kong, protests have turned into real clashes between protesters and police. Meanwhile, the trade dispute between the US and China remains unresolved.

On other fronts, the Australian dollar continued to decline, with three-year yields falling below 1 percent after unemployment figures showed more than expected growth. The emerging market shares retreated for a second day.

What next:

- Meeting on Thursday between the eurozone finance ministers in Luxembourg. There will be debated the eurozone budget and penalties against Italy for failing to meet their debt requirements

- China and US industrial production figures on Friday

For the shares:

- The S & P500 is up 0.3%

- Stoxx Europe 600 ended an increase of 0.2%

- The MSCI Emerging Markets Index fell 0.4%

- MSCI Asia Pacific declined by 0.5%

For currencies:

- The Bloomberg Dollar Index remained almost unchanged

- The euro is down 0.1%

- The British pound is almost unchanged at around $ 1.2685

- The Japanese yen also has a minimum change of around 108.49

Bonds:

- US bond yields fell to 2.11%

- German 10-year-olds remained almost unchanged at -0.24%

- British 10-year fell to 0.84%

Raw materials:

- West Texas Instruments is up nearly 4%

- Gold for the moment is up 0.2%

Source: Bloomberg Finance L.P.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.