- Home

- >

- Daily Accents

- >

- The market situation so far – risky assets retreat, oil below $ 60

The market situation so far - risky assets retreat, oil below $ 60

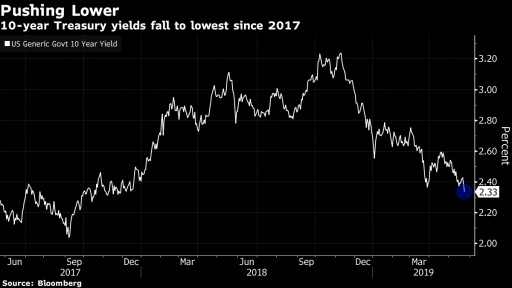

The European session ended in deep red territory and the sale of US stocks continued. Traders have begun to look for bond and gold security after China and the United States have confirmed their aggressive positions in the raging trade war. The yen continues to rise against the dollar, and yields of 10-year-olds have reached their lowest level since 2017.

US indices report a decline for the second consecutive day, with the DJIA down by about 400 points. The impact on the indices has been plagued by the news that China accepts the intentions of US companies to withdraw from China as a far-reaching measure and jeopardizing China's economy.

The sectors most dependent on the situation of the war, such as chips, electronics, the automotive industry and resources, have stepped up their retreat. Markets in the emerging markets have also been defeated, while West Texas's state-run crude oil fell below $ 60 a barrel. The profitability of the German bundle and the British gilt reached two-year lows.

Risk assets remain under strong pressure, while "havens" enjoy strong demand. According to some experts, the trade war may last until 2035, and economists are also becoming increasingly pessimistic. Goldman Sachs are now more likely to have a full stalemate, and Nomura Holdings forecast a full rate escalation.

Source: Bloomberg Finance L.P.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.