- Home

- >

- FX Daily Forecasts

- >

- The moods in Bank Of England before the interest rate decision on Thursday

The moods in Bank Of England before the interest rate decision on Thursday

BOE decides on interest rates this week, that's what the moods are among the members

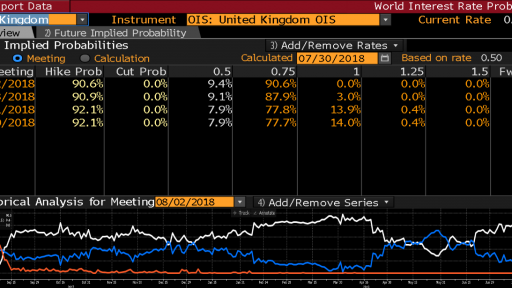

As the Bank of England (BoE) is approaching on Thursday, it will decide on a change in interest rates, expectations for interest rates are becoming more optimistic.

Currently, traders estimate the likelihood of interest rates rising to over 90% (Almost sure increase). The latest economic data coming from the island indicates an improvement in the British economy, and it will definitely give hope to central bankers. Here are the moods among themselves:

1. Mark Carney - Neutral

1. Mark Carney - Neutral

Change from last vote - No

After the highly criticized central bank intervention and the calls for a lower rate of increase, the governor of the central bank will remain neutral. However, at its last meeting, Carney said the recent economic data was encouraging, supporting the view that the economy would require higher interest rates.

2. Ben Broadbent - Neutral

2. Ben Broadbent - Neutral

Change from last vote - No

The deputy governor of the central bank, known as the majority vote, will play his cards near his chest. As the last politician who had to speak to an audience before the vote, he was asked whether he would support the increase in interest by saying, "I do not know and I will not tell you."

3. Dave Ramsden - For a Decrease

3. Dave Ramsden - For a Decrease

Change from last vote - No

Worried about the lack of wage growth, Ramsden believes the current economic growth is very weak and barely covers Brexit's current impact. Ramsden expects the economic situation of the UK to deteriorate significantly after the country finally leaves the EU.

4. Jon Cunliffe - Dovish

4. Jon Cunliffe - Dovish

Change from last vote - No

Cunliffe is considered one of Bank of England's most oriented members, who will vote against the interest rate hike next week. He is of the opinion that the central bank has to raise interest rates, but not with such a magnitude. As a major reason, it highlights the slow growth of the economy. Economists believe he will certainly vote against the rise in interest rates.

5. Andy Haldane - Hawkish

5. Andy Haldane - Hawkish

Change from last vote - No

Chief economist at BOE surprised investors by changing their minds in June in support of an immediate increase, saying rising wage growth and rising inflation show that the economy is ready for higher interest rates. Raising salaries for public sector workers will have side effects elsewhere due to the tight labor market, he said.

6. Silvana Tenreyro - Neutral

6. Silvana Tenreyro - Neutral

Change from last vote - No

The London School of Economics has also joined Carney's point of view, saying the weakness in the UK's first quarter seems to be temporary and that it will monitor the data closely. In June, she said the models showed a wait-and-see, but waiting for too long made it more difficult to achieve the inflation target. For the most part, to raise interest rates.

7. Ian McCafferty - Hawkish

7. Ian McCafferty - Hawkish

Change from last vote - Yes, to hawkish

As probably the biggest hawkish supporter among MPC members, Ian McCafferty will take the opportunity to vote for interest rates. He said in June that BOE should raise interest rates now to prevent the need for too aggressive tightening. McCafferty will be replaced by Jonathan Haskell in September.

8. Gertjan Vlieghe - Hawkish

8. Gertjan Vlieghe - Hawkish

Change from last vote - No

According to him, one or two interest rises will be needed by the end of the year, hoping the first one is next week. For months, Vlieghe argues that avoiding a sharp tightening of monetary policy should be a top priority for the central bank. Gradual and continuous promotion, the only option.

9. Michael Saunders - Hawkish

9. Michael Saunders - Hawkish

Change from last vote - Yes, to hawkish

After voting for an interest rate increase with Ian McCafferty for the last three meetings, Saunders is likely to do so again in August. He said earlier this month that prices are likely to rise faster than the markets are currently accumulating. At the same time, he says: "The overall picture is still limited and gradual, and I think the increase in interest rates is not too fast."

Source: Bloomberg

Trader Georgi Bozhidarov

Trader Georgi Bozhidarov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.